Filed Pursuant to General Instruction II.L. of Form F-10

File No. 333-222413

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

This prospectus supplement, together with the short form base shelf prospectus dated March 26, 2018 to which it relates, as amended or supplemented, and each document incorporated or deemed to be incorporated by reference in the short form base shelf prospectus, constitutes a public offering of securities offered pursuant hereto only in the jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities. See “Plan of Distribution.”

Information has been incorporated by reference in this prospectus supplement from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Aurinia Pharmaceuticals Inc. at 1200 Waterfront Centre, 200 Burrard Street, P.O. Box 48600, Vancouver, British Columbia, Canada, V7X 1T2, telephone (604) 632-3473, and are also available electronically at www.sec.gov/edgar.shtml or www.sedar.com.

PROSPECTUS SUPPLEMENT No. 1

To the Short Form Base Shelf Prospectus Dated March 26, 2018

| Secondary Offering | April 5, 2018 |

AURINIA PHARMACEUTICALS INC.

4,492,098 Common Shares

This prospectus supplement relates to the periodic resale of common shares (“Common Shares”) in the capital of Aurinia Pharmaceuticals Inc. (“Aurinia,” the “Company,” “we,” “us” or “our”) by the holders of certain of our common share purchase warrants (each a “Warrantholder”) during the period that the accompanying short form base shelf prospectus dated March 26, 2018, including any amendments thereto, remains valid (the “Offering”). In connection with (i) the sale of securities (the “June 2016 Private Placement”) on a private placement basis to certain of the Warrantholders and (ii) the sale of securities (the “December 2016 Public Offering”) under a public offering to certain of the Warrantholders, this prospectus supplement covers resales by the Warrantholders, from time to time, of up to 968,432 Common Shares issuable on the exercise of common share purchase warrants exercisable for a period of two years from the date of issuance at an exercise price of US$2.77 (a “June 2016 Warrant”) and up to 3,523,666 Common Shares issuable on the exercise of common share purchase warrants exercisable for a period of five years from the date of issuance at an exercise price of US$3.00 (a “December 2016 Warrant”) (collectively, the “Registrable Common Shares”). See “Plan of Distribution”. In connection with the June 2016 Private Placement, we entered into a registration rights agreement dated June 22, 2016 (the “Registration Rights Agreement”) with certain Warrantholders. We agreed in the Registration Rights Agreement to bear all fees and expenses incident to the registration of the Registrable Common Shares, other than fees and disbursements of counsel to the applicable Warrantholders. The Registrable Common Shares were previously registered pursuant to a prior short form base shelf prospectus which has since expired.

No underwriter has been involved in the preparation of, or has performed any review of, this prospectus supplement.

Our Common Shares are listed and posted for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “AUP” and on the Nasdaq Global Market (the “Nasdaq”) under the symbol “AUPH.” On April 4, 2018, the closing price of the Common Shares on the TSX was CDN$6.74 and the closing price of the Common Shares on the Nasdaq was US$5.29.

Investing in our securities involves a high degree of risk. You should carefully read the “Risk Factors” section in this prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein and therein, as well as the information under the heading “Cautionary Note Regarding Forward Looking Information” in this prospectus supplement, and consider such notes and information in connection with an investment in any securities.

The Warrantholders may, from time to time, sell, transfer or otherwise dispose of any or all of the Registrable Common Shares or interests in the Registrable Common Shares on any stock exchange, market or trading facility on which the Registrable Common Shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. Prices may vary from purchaser to purchaser during the period of distribution. See “Plan of Distribution”. This prospectus supplement has not been filed in respect of, and will not qualify, any distribution of the Registrable Common Shares in British Columbia or in any other province or territory of Canada at any time. We will not receive any of the proceeds from the sale or other disposition of the Registrable Common Shares by the Warrantholders. The net proceeds received from the sale or other disposition of the Registrable Common Shares by the Warrantholders, if any, is unknown.

Investors should rely only on current information contained in or incorporated by reference into this prospectus supplement as such information is accurate only as of the date of the applicable document. We have not authorized anyone to provide investors with different information. Information contained on our website shall not be deemed to be a part of this prospectus supplement or incorporated by reference and should not be relied upon by prospective investors for the purpose of determining whether to invest in the securities. These securities are not being offered in any jurisdiction where the offer or sale is not permitted. Investors should not assume that the information contained in this prospectus supplement is accurate as of any date other than the date on the face page of this prospectus supplement or the date of any documents incorporated by reference herein.

We are permitted under a multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States to prepare this prospectus supplement and the accompanying prospectus in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States. The financial statements incorporated by reference in this prospectus supplement and the accompanying prospectus have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, and are subject to Canadian auditing and auditor independence standards. As a result, our financial statements may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the owning our securities may have tax consequences both in Canada and the United States. Such consequences, for investors who are resident in, or citizens of, the United States, may not be described fully in this prospectus supplement, including the Canadian federal income tax consequences applicable to a foreign controlled Canadian corporation that acquires Common Shares. Investors should read the tax discussion in this prospectus supplement and the accompanying prospectus and consult their own tax advisors with respect to their own particular circumstances. See the sections titled “Certain Canadian Federal Income Tax Considerations,” “Material U.S. Federal Income Taxation Considerations” and “Risk Factors.”

Your ability to enforce civil liabilities under the United States federal securities laws may be affected adversely because we are incorporated in Canada, most of the officers and directors and some of the experts named in this prospectus supplement are not residents of the United States, and many of our assets and all or a substantial portion of the assets of such persons are located outside of the United States. See “Enforceability of Certain Civil Liabilities.”

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state or Canadian securities regulator has approved or disapproved the securities offered hereby; passed upon the accuracy or adequacy of this prospectus supplement or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Our registered office is located at #201, 17904 – 105 Avenue, Edmonton, Alberta T5S 2H5, Canada. Our head office is located at #1203-4464 Markham Street, Victoria, British Columbia V8Z 7X8, Canada.

PROSPECTUS SUPPLEMENT

| S-1 | ||||

| S-1 | ||||

| S-2 | ||||

| S-5 | ||||

| S-7 | ||||

| S-7 | ||||

| S-7 | ||||

| S-7 | ||||

| S-11 | ||||

| S-11 | ||||

| S-11 | ||||

| S-12 | ||||

| S-13 | ||||

| S-14 | ||||

| S-14 | ||||

| S-14 | ||||

| S-19 | ||||

| S-23 | ||||

| S-25 | ||||

| S-25 | ||||

| S-26 | ||||

| S-26 | ||||

| S-26 | ||||

| S-26 | ||||

| C-1 | ||||

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the securities that are being offered pursuant to this prospectus supplement and the method of distribution of those securities and also supplements and updates information regarding us contained in the accompanying prospectus. The second part, the accompanying prospectus, gives more general information about securities we may offer from time to time, some of which may not apply to the securities offered pursuant to this prospectus supplement. Both documents contain important information you should consider when making your investment decision. This prospectus supplement may add, update or change information contained in the accompanying prospectus. Before investing, you should carefully read both this prospectus supplement and the accompanying prospectus together with the additional information about us to which we refer you in the sections of this prospectus supplement titled “Documents Incorporated by Reference” and “Where You Can Find More Information.”

You should rely only on information contained in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference in this prospectus supplement and the accompanying prospectus. If information in this prospectus supplement is inconsistent with the accompanying prospectus or the information incorporated by reference, you should rely on this prospectus supplement. We have not authorized anyone to provide you with information that is different. If anyone provides you with any different or inconsistent information, you should not rely on it. The Common Shares will be offered only in jurisdictions where such offers are permitted by law. This prospectus supplement has not been filed in respect of, and will not qualify, any distribution of the Registrable Common Shares in British Columbia or in any other province or territory of Canada at any time. The information contained in this prospectus supplement and the accompanying prospectus is accurate only as of their respective dates, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus and you should not assume otherwise.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus supplement and the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of a “shelf” registration statement on Form F-10 that we filed with the SEC. The shelf registration statement was declared effective by the SEC on March 29, 2018. This prospectus supplement does not contain all of the information contained in the registration statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC. You should refer to the registration statement and the exhibits to the registration statement for further information with respect to us and our securities.

In this prospectus supplement, unless stated otherwise or the context requires, all dollar amounts are expressed in U.S. dollars. All references to “$” or “US$” are to the lawful currency of the United States and all references to “CDN$” are to the lawful currency of Canada. This prospectus supplement and the documents incorporated by reference contain translations of some Canadian dollar amounts into U.S. dollars solely for your convenience. See the section titled “Exchange Rate Information.”

Market data and certain industry forecasts used in this prospectus supplement and the documents incorporated by reference herein or therein were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

S-1

In this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, unless the context otherwise requires, references to “we,” “us,” “our” or similar terms, as well as references to “Aurinia” or the “Company,” refer to Aurinia Pharmaceuticals Inc., together with our subsidiaries.

This prospectus supplement is deemed to be incorporated by reference into the accompanying prospectus solely in connection with the Registrable Common Shares. Other documents are also incorporated or deemed to be incorporated by reference into this prospectus supplement and into the accompanying prospectus. See the section titled “Documents Incorporated by Reference.”

This prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein and therein contain “forward-looking statements” or “forward-looking information” within the meaning of applicable securities legislation.

A statement is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements may include words such as “anticipate”, “believe”, “intend”, “expect”, “goal”, “may”, “outlook”, “plan”, “seek”, “project”, “should”, “strive”, “target”, “could”, “continue”, “potential” and “estimated”, or the negative of such terms or comparable terminology. You should not place undue reliance on the forward-looking statements, particularly those concerning anticipated events relating to the development, clinical trials, regulatory approval, and marketing of our product and the timing or magnitude of those events, as they are inherently risky and uncertain.

Securities laws encourage companies to disclose forward-looking information so that investors can get a better understanding our future prospects and make informed investment decisions. These statements, made either in this prospectus supplement or a document incorporated by reference in this prospectus supplement, may include, without limitation:

| • | our belief that the Phase IIb lupus nephritis AURA- LV (“AURA”) clinical trial had positive results; |

| • | our belief that we have sufficient cash resources to adequately fund operations through Phase III lupus nephritis (“AURORA”) clinical trial results and regulatory submission; |

| • | our belief that confirmatory data generated from the single AURORA clinical trial and the recently completed AURA clinical trial should support regulatory submissions in the United States, Europe and Japan and the timing of such, including the New Drug Application submission in the United States; |

| • | our belief that recently granted formulation patents regarding the delivery of voclosporin to the ocular surface for conditions such as dry eye have the potential to be of therapeutic value; |

| • | our plans and expectations and the timing of commencement, enrollment, completion and release of results of clinical trials; |

| • | our current forecast for the cost of the AURORA clinical trial and the continuation study; |

| • | our intention to seek regulatory approvals in the United States, Europe and Japan for voclosporin and anticipated timing of receiving approval; |

| • | our intention to demonstrate that voclosporin possesses pharmacologic properties with the potential to demonstrate best-in-class differentiation with first-in-class status for the treatment of lupus nephritis (“LN”) outside of Japan; |

| • | our belief in voclosporin being potentially a best-in-class CNI (as defined below) with robust intellectual property exclusivity and the benefits over existing commercially available CNIs; |

| • | our belief that voclosporin has further potential to be effectively used across a range of therapeutic autoimmune areas including focal segmental glomerularsclerosis (“FSGS”) and dry eye syndrome (“DES”); |

S-2

| • | our intention to initiate a Phase II clinical trial for voclosporin in FSGS patients and the timing for commencement and for data availability for the same; |

| • | our intention to commence a Phase IIa tolerability study of voclosporin ophthalmic solution (“VOS”) and the timing for commencement and for data availability for the same; |

| • | statements concerning the anticipated commercial potential of voclosporin for the treatment of LN, FSGS and DES; |

| • | our belief that the expansion of the renal franchise could create significant value for shareholders; |

| • | our intention to use the net proceeds from financings for various purposes; |

| • | our belief that Aurinia’s current financial resources are sufficient to fund all existing programs, the new indication expansion and new product development work and supporting operations into 2020. |

| • | our plans to generate future revenues from products licensed to pharmaceutical and biotechnology companies |

| • | statements concerning partnership activities and health regulatory discussions; |

| • | statements concerning the potential market for voclosporin; |

| • | our ability to take advantage of financing opportunities if and when needed; |

| • | our belief that VOS has the potential to compete in the multi-billion-dollar human prescription dry eye market; |

| • | our intention to seek additional corporate alliances and collaborative agreements to support the commercialization and development of our product; and |

| • | our belief that the annualized pricing for voclosporin could range between $45,000-$100,000 in the United States. |

Such statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based on a number of estimates and assumptions that, while considered reasonable by management, as at the date of such statements, are inherently subject to significant business, economic, competitive, political, regulatory, legal, scientific and social uncertainties and contingencies, many of which, with respect to future events, are subject to change. The factors and assumptions used by management to develop such forward-looking statements include, but are not limited to:

| • | the assumption that we will be able to obtain approval from regulatory agencies on executable development programs with parameters that are satisfactory to us; |

| • | the assumption that recruitment to clinical trials will occur as projected; |

| • | the assumption that we will successfully complete our clinical programs on a timely basis, including conducting the required AURORA clinical trial and meet regulatory requirements for approval of marketing authorization applications and new drug approvals, as well as favourable product labelling; |

| • | the assumption that the planned studies will achieve positive results; |

| • | the assumptions regarding the costs and expenses associated with Aurinia’s clinical trials; |

| • | the assumption the regulatory requirements and commitments will be maintained; |

| • | the assumption that we will be able to meet GMP standards and manufacture and secure a sufficient supply of voclosporin on a timely basis to successfully complete the development and commercialization of voclosporin; |

| • | the assumptions on the market value for the LN program; |

| • | the assumption that our patent portfolio is sufficient and valid; |

S-3

| • | the assumption that we will be able to extend our patents on terms acceptable to us; |

| • | the assumptions on the market; |

| • | the assumption that there is a potential commercial value for other indications for voclosporin; |

| • | the assumption that market data and reports reviewed by us are accurate; |

| • | the assumption that another company will not create a substantial competitive product for Aurinia’s LN business without violating Aurinia’s intellectual property rights; |

| • | the assumptions on the burn rate of Aurinia’s cash for operations; |

| • | the assumption that our current good relationships with our suppliers, service providers and other third parties will be maintained; |

| • | the assumption that we will be able to attract and retain a sufficient amount of skilled staff and/or |

| • | the assumptions relating to the capital required to fund operations through AURORA clinical trial results and regulatory submission. |

It is important to know that:

| • | actual results could be materially different from what we expect if known or unknown risks affect our business, or if our estimates or assumptions turn out to be inaccurate. As a result, we cannot guarantee that any forward-looking statement will materialize and, accordingly, you are cautioned not to place undue reliance on these forward-looking statements. |

| • | forward-looking statements do not take into account the effect that transactions or non-recurring or other special items announced or occurring after the statements are made may have on our business. For example, they do not include the effect of mergers, acquisitions, other business combinations or transactions, dispositions, sales of assets, asset write-downs or other charges announced or occurring after the forward-looking statements are made. The financial impact of such transactions and non-recurring and other special items can be complex and necessarily depends on the facts particular to each of them. Accordingly, the expected impact cannot be meaningfully described in the abstract or presented in the same manner as known risks affecting our business. |

The factors discussed below and other considerations discussed in the “Risk Factors” section of this prospectus supplement could cause our actual results to differ significantly from those contained in any forward-looking statements.

Such forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to differ materially from any assumptions, further results, performance or achievements expressed or implied by such forward-looking statements. Important factors that could cause such differences include, among other things, the following:

| • | the need for additional capital in the longer term to fund our development programs and the effect of capital market conditions and other factors on capital availability; |

| • | competition in our marketplace; |

| • | difficulties, delays, or failures we may experience in the conduct of and reporting of results of our clinical trials for voclosporin; |

| • | difficulties in meeting Good Manufacturing Practice (“GMP”) standards and the manufacturing and securing a sufficient supply of voclosporin on a timely basis to successfully complete the development and commercialization of voclosporin; |

| • | difficulties, delays or failures in obtaining regulatory approvals for the initiation of clinical trials; |

S-4

| • | difficulties in gaining alignment among the key regulatory jurisdictions, European Medicines Agency (“EMA”), Food and Drug Administration (“FDA”) and Pharmaceutical and Medical Devices Agency (“PMDA”), which may require further clinical activities; |

| • | difficulties, delays or failures in obtaining regulatory approvals to market voclosporin; |

| • | not being able to extend our patent portfolio for voclosporin; |

| • | difficulties we may experience in completing the development and commercialization of voclosporin; |

| • | the market for the LN business may not be as we have estimated; |

| • | insufficient acceptance of and demand for voclosporin; |

| • | difficulties obtaining adequate reimbursements from third party payors; |

| • | difficulties obtaining formulary acceptance; |

| • | competitors may arise with similar products; |

| • | product liability, patent infringement and other civil litigation; |

| • | injunction, court orders, regulatory and other enforcement actions; |

| • | we may have to pay unanticipated expenses, and/or estimated costs for clinical trials or operations may be underestimated, resulting in our having to make additional expenditures to achieve our current goals; |

| • | difficulties, restrictions, delays, or failures in obtaining appropriate reimbursement from payers for voclosporin; and/or |

| • | difficulties we may experience in identifying and successfully securing appropriate vendors to support the development and commercialization of our product. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. These forward-looking statements are made as of the date of this prospectus supplement or, in the case of documents incorporated by reference in this prospectus supplement, as of the date of such documents and we disclaim any intention and have no obligation or responsibility, except as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this prospectus supplement from documents filed with securities commissions or similar authorities in Canada which have also been filed with, or furnished to, the SEC. Copies of the documents incorporated by reference in this prospectus supplement and not delivered with this prospectus supplement may be obtained on request without charge from our Corporate Secretary at 1200 Waterfront Centre, 200 Burrard Street, P.O. Box 48600, Vancouver, British Columbia V7X 1T2, Canada, Telephone: (604) 632-3473 or by accessing the disclosure documents through the Internet on the Canadian System for Electronic Analysis and Retrieval, or SEDAR, at www.sedar.com. Documents filed with, or furnished to, the SEC are available through the SEC’s Electronic Data Gathering and Retrieval System, or EDGAR, at www.sec.gov.

The following documents, filed with the securities commissions or similar regulatory authorities in British Columbia, Alberta and Ontario, and filed with, or furnished to, the SEC are specifically incorporated by reference into, and form an integral part of, this prospectus supplement:

| (a) | our annual information form dated March 13, 2018 for the fiscal year ended December 31, 2017; |

S-5

| (b) | our audited consolidated financial balance sheets as at December 31, 2017 and 2016 and the consolidated statements of operations and comprehensive loss, changes in shareholders’ equity (deficit) and cash flows for the two-year period ended December 31, 2017, including notes thereto and the auditors’ report thereon, as filed on March 15, 2018; |

| (c) | our management’s discussion and analysis of financial condition and results of operations for the year ended December 31, 2017; and |

| (d) | our management information circular dated May 12, 2017 in connection with the annual general meeting of our shareholders on June 21, 2017. |

Any documents of the type described in Section 11.1 of Form 44-101F1 Short Form Prospectuses that we have filed with a securities commission or similar authority in any jurisdiction of Canada subsequent to the date of this prospectus supplement and during the period that this prospectus supplement is effective will be deemed to be incorporated by reference into this prospectus supplement.

In addition, to the extent that any document or information incorporated by reference into this prospectus supplement is filed with, or furnished to, the SEC pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after the date of this prospectus supplement, that document or information will be deemed to be incorporated by reference as an exhibit to the registration statement of which this prospectus supplement forms a part (in the case of a report on Form 6-K, if and to the extent expressly provided therein).

Any statement contained in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference in this prospectus supplement shall be deemed to be modified or superseded, for the purposes of this prospectus supplement, to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

Upon filing a new annual information form and the related annual financial statements and management’s discussion and analysis with applicable securities regulatory authorities during the currency of this prospectus supplement, the previous annual information form, the previous annual financial statements and management’s discussion and analysis and all quarterly financial statements, supplemental information and material change reports filed prior to the commencement of our financial year in which the new annual information form is filed will be deemed no longer to be incorporated into this prospectus supplement for purposes of future offers and sales of the Securities under this prospectus supplement. Upon interim consolidated financial statements and the accompanying management’s discussion and analysis being filed by us with the applicable securities regulatory authorities during the duration of this prospectus supplement, all interim consolidated financial statements and the accompanying management’s discussion and analysis filed prior to the new interim consolidated financial statements shall be deemed no longer to be incorporated into this prospectus supplement for purposes of future offers and sales of Securities under this prospectus supplement. Upon a new management information circular in connection with an annual meeting of shareholders being filed by us with the applicable securities regulatory authorities during the duration of this prospectus supplement, the management information circular filed in connection with the previous annual meeting of shareholders will be deemed no longer to be incorporated by reference in this prospectus supplement for purposes of future offers and sales of Securities under this prospectus supplement.

S-6

References to our website in any documents that are incorporated by reference into this prospectus supplement do not incorporate by reference the information on such website into this prospectus supplement or the accompanying prospectus, and we disclaim any such incorporation by reference.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

In addition to the documents specified in this prospectus supplement under the section titled “Documents Incorporated by Reference,” the following documents have been or will be (through post-effective amendment or incorporation by reference) filed with the SEC as part of the registration statement insofar as required by the SEC’s Form F-10: (i) powers of attorney from our directors and officers; and (ii) the consents of auditors and legal counsel.

The following description of Aurinia is derived from selected information about us contained in the documents incorporated by reference and does not contain all of the information about us and our business that should be considered before investing in the securities. This prospectus supplement may add to, update or change information in the accompanying prospectus. You should carefully read this entire prospectus supplement and the accompanying prospectus, including the risks and uncertainties discussed in the section titled “Risk Factors,” and the information incorporated by reference in this prospectus supplement, including our consolidated financial statements, before making an investment decision. If you invest in our securities, you are assuming a high degree of risk.

We are a clinical stage biopharmaceutical company with a head office at #1203-4464 Markham Street, Victoria, British Columbia V8Z 7X8. Our registered office is located at #201, 17904-105 Avenue, Edmonton, Alberta T5S 2H5 where the finance function is performed.

We are organized under the Business Corporations Act (Alberta). The Common Shares are currently listed and traded on the Nasdaq under the symbol “AUPH” and on the TSX under the symbol “AUP”. Our primary business is the development of a therapeutic drug to treat autoimmune diseases, in particular LN.

We have the following wholly-owned subsidiaries: Aurinia Pharma U.S., Inc. (Delaware incorporated) and Aurinia Pharma Limited (UK incorporated).

Our By-Law No. 2 was amended at a shareholder’s meeting held on August 15, 2013 to include provisions requiring advance notice for any nominations of directors by shareholders, which are described further in our most recent information circular.

SUMMARY DESCRIPTION OF BUSINESS

We are focused on the development of our novel therapeutic immunomodulating drug candidate, voclosporin, for the treatment of LN, FSGS and DES. Voclosporin is a next generation calcineurin inhibitor (“CNI”) which has clinical data in over 2,400 patients across multiple indications. It has also been previously studied in kidney rejection following transplantation, psoriasis and in various forms of uveitis (an ophthalmic disease).

Legacy CNIs have demonstrated efficacy for a number of conditions, including LN, transplant, DES and other autoimmune diseases; however, side effects exist which can limit their long-term use and tolerability. Some clinical complications of legacy CNIs include hypertension, hyperlipidemia, diabetes, and both acute and chronic nephrotoxicity.

S-7

Voclosporin is an immunosuppressant, with a synergistic and dual mechanism of action that has the potential to improve near- and long-term outcomes in LN when added to mycophenolate mofetil (“MMF”), although not approved for such, the current standard of care for LN. By inhibiting calcineurin, voclosporin reduces cytokine activation and blocks interleukin IL-2 expression and T-cell mediated immune responses. Voclosporin also potentially stabilizes disease modifying podocytes, which protects against proteinuria. Voclosporin is made by a modification of a single amino acid of the cyclosporine molecule which has shown a more predictable pharmacokinetic and pharmacodynamic relationship, an increase in potency, an altered metabolic profile, and easier dosing without the need for therapeutic drug monitoring. Clinical doses of voclosporin studied to date range from 13 – 70 mg BID. The mechanism of action of voclosporin, a CNI, has been validated with certain first generation CNIs for the prevention of rejection in patients undergoing solid organ transplants and in several autoimmune indications, including dermatitis, keratoconjunctivitis sicca (“Dry Eye Syndrome” or “DES”), psoriasis, rheumatoid arthritis, and for LN in Japan.

We believe that voclosporin possesses pharmacologic properties with the potential to demonstrate best-in-class differentiation with first-in-class regulatory approval status for the treatment of LN outside of Japan.

Based on published data, we believe the key potential benefits of voclosporin in the treatment of LN are as follows:

| • | increased potency compared to cyclosporine A, allowing lower dosing requirements and fewer off target effects; |

| • | limited inter and intra patient variability, allowing for easier dosing without the need for therapeutic drug monitoring; |

| • | less cholesterolemia and triglyceridemia than cyclosporine A; and |

| • | limited incidence of glucose intolerance and diabetes at therapeutic doses compared to tacrolimus. |

Lupus Nephritis

LN is an inflammation of the kidney caused by systemic lupus erythematosus (“SLE”) and represents a serious manifestation of SLE. SLE is a chronic, complex and often disabling disorder. SLE is highly heterogeneous, affecting a wide range of organs and tissue systems. Unlike SLE, LN has straightforward disease measures (readily assessable and easily identified by specialty treaters) where an early response correlates with long-term outcomes, measured by proteinuria. In patients with LN, renal damage results in proteinuria and/or hematuria and a decrease in renal function as evidenced by reduced estimated glomerular filtration rate (“eGFR”), and increased serum creatinine levels. eGFR is assessed through the Chronic Kidney Disease Epidemiology Collaboration equation. Rapid control and reduction of proteinuria in LN patients measured at 6 months shows a reduction in the need for dialysis at 10 years (Chen et al., Clin J. Am Soc Neph., 2008). LN can be debilitating and costly and if poorly controlled, can lead to permanent and irreversible tissue damage within the kidney. Recent literature suggests severe LN progresses to end-stage renal disease (“ESRD”), within 15 years of diagnosis in 10%-30% of patients, thus making LN a serious and potentially life-threatening condition. SLE patients with renal damage have a 14-fold increased risk of premature death, while SLE patients with ESRD have a greater than 60-fold increased risk of premature death. Mean annual cost for patients (both direct and indirect) with SLE (with no nephritis) have been estimated to exceed $20,000 per patient, while the mean annual cost for patients (both direct and indirect) with LN who progress to intermittent ESRD have been estimated to exceed $60,000 per patient (Carls et al., JOEM., Volume 51, No. 1, January 2009).

FSGS

FSGS is a lesion characterized by persistent scarring identified by biopsy and proteinuria. FSGS is a cause of Nephrotic Syndrome (“NS”) and is characterized by high morbidity. NS is a collection of symptoms that indicate kidney damage, including: large amounts of protein in the urine; low levels of albumin and higher than normal fat and cholesterol levels in the blood, and edema. Similar to LN, early clinical response and reduction of proteinuria is thought to be critical to long-term kidney health and outcomes.

S-8

FSGS is likely the most common primary glomerulopathy and the most common primary glomerulopathy leading to ESRD. The incidence of FSGS and ESRD due to FSGS are increasing as time goes on. Precise estimates of incidence and prevalence are difficult to determine. According to NephCure Kidney International, more than 5400 patients are diagnosed with FSGS every year; however, this is considered an underestimate because a limited number of biopsies are performed. The number of FSGS cases are rising more than any other cause of NS and the incidence of FSGS is increasing through disease awareness and improved diagnosis. FSGS occurs more frequently in adults than in children and is most prevalent in adults 45 years or older. FSGS is most common in people of African American and Asian descent. It has been shown that the control of proteinuria is important for long-term dialysis-free survival of these patients. Currently, there are no approved therapies for FSGS in the United States and Europe.

DES

DES, or keratoconjunctivitis sicca, is a chronic disease in which a lack of moisture and lubrication on the eye’s surface results in irritation and inflammation of the eye. DES is a multifactorial, heterogeneous disease estimated to affect greater than 20 million people in the United States (Market Scope, 2010 Comprehensive Report on The Global Dry Eye Products Market).

LN Standard of Care

While at Aspreva, certain members of Aurinia’s management team executed the ALMS study which established CellCept® as the current standard of care for treating LN. The ALMS study was published in 2009 in the Journal of the American Society of Nephrology and in 2011 in the New England Journal of Medicine.

The American College of Rheumatology recommends that intravenous cyclophosphamide or MMF/CellCept® be used as first-line immunosuppressive therapy for LN. Despite their use, the ALMS study showed that the vast majority of patients failed to achieve CR, and almost half failed to have a renal response at 24 weeks for both of these therapeutics. Based upon the results of the ALMS study, we believe that a better solution is needed to improve renal response rates for LN.

Despite CellCept® being the current SoC for the treatment of LN, it remains far from adequate with fewer than 20% of patients on therapy actually achieving disease remission after six months of therapy. Data suggests that a LN patient who does not achieve rapid disease remission upon treatment is more likely to experience renal failure or require dialysis at 10 years (Chen YE, Korbet SM, Katz RS, Schwartz MM, Lewis EJ; the Collaborative Study Group. Value of a complete or partial remission in severe lupus nephritis. Clin J Am Soc Nephrol. 2008;3:46-53.). Therefore, it is critically important to achieve disease remission as quickly and as effectively as possible.

Based on available data from the AURA clinical trial, we believe that voclosporin has the potential to address the critical need for LN by controlling active disease rapidly, lowering the overall steroid burden, impacting extra-renal disease and doing so with a convenient oral twice-daily treatment regimen.

Market Potential and Commercial Considerations

Our target launch date for voclosporin as a treatment for LN is late 2020 or early 2021.

The global immunology market which covers autoimmune conditions including SLE is set to rise from $57.7 billion in 2015 to $75.4 billion by 2022 according to GBI Research with the United States accounting for half of the market. The growth in the market is driven by continued increase in prevalence and incidence of autoimmune conditions in addition to new market entrants that are targeting better outcomes. There is significant unmet need for new therapies specifically in SLE and LN.

S-9

We have conducted market research including claims database reviews (where available) and physician based research. Our physician research included approximately 900 rheumatologists and nephrologists across the United States, Europe and Japan to better define the potential market size, estimated pricing and treatment paradigms in those jurisdictions. Using the U.S. MarketScan® database (with approximately ~180,000,000 insured lives in the United States) there were 445,000 SLE patients in the database (between January 2006 and June 2016) based on specific SLE diagnosis codes. The National Institute of Diabetes and Digestive and Kidney Diseases estimates that up to 50% of people with SLE are diagnosed with LN. The Lupus Foundation of America estimates that 60% of people with lupus may develop kidney problems. Using claims database research and physician research, we believe the diagnosed range of LN patients to be approximately 125,000 to 200,000 in the United States and 150,000 to 215,000 for Europe and Japan combined. In the United States, Europe and Japan, one in five LN patients are thought to be undiagnosed due to referring physicians being inefficient and inaccurate in diagnosing the condition according to our research.

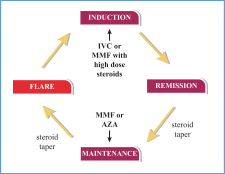

Similar to other autoimmune disorders, LN is a flaring and remitting disease. The destructive disease cycle people with LN go through is depicted below. The disease cycles from being in remission to being in flare, achieving partial remission and being back in remission. Treatment objectives between LN and other autoimmune diseases are remarkably similar. In other autoimmune conditions such as Multiple Sclerosis, Crohn’s, Rheumatoid Arthritis and SLE physicians goals are to induce/maintain a remission of disease, decrease frequency of hospital or ambulatory care visits and limit long term disability. In LN specifically, physicians are trying to avoid further kidney damage, dialysis, renal transplantation, and death. According to a physician survey, the frequency of LN flares amongst treated patients was approximately every 14 months across the United States and Europe. The ability to get patients into remission quickly correlates with better long-term kidney outcomes as noted above.

The population of people with LN will be in different cycles of their disease at any one time. Physicians currently use existing LN standard of care including immunosuppressants and high dose steroids to treat people with LN throughout the disease cycles including induction and maintenance phases. By studying voclosporin on top of an existing standard of care we are not seeking to displace current accepted treatment patterns. We feel that being additive to an existing standard of care in addition to the product being administered orally versus via infusion or injection can support a more rapid market adoption if approved.

Current annualized pricing (based on wholesale acquisition costs published by AnalySource® Reprinted with permission by First Databank, Inc. All rights reserved. © (2018)) for the treatments of other more prevalent autoimmune conditions such as Multiple Sclerosis, Crohn’s, Rheumatoid Arthritis and SLE ranges from $45,000-$100,000 in the United States. Wholesale acquisition cost is the manufacturer’s published catalog or list price for a drug product to wholesalers. We have conducted pricing research that studied a similar pricing range with payers and physicians and believe that pricing in this range can be achievable for voclosporin in the United States. Pricing for other autoimmune conditions is lower in Europe and Japan than it is in the United States driven by the specific country’s pricing and reimbursement processes. We expect that will be the case for voclosporin. We believe the United States will provide the largest market opportunity for the Company followed by Europe and Japan.

S-10

An investment in our securities is speculative and involves a high degree of risk. In addition to the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, you should carefully consider the risks and uncertainties described under the heading “Risk Factors” in the accompanying prospectus, together with all of the other information contained in this prospectus supplement and the accompanying prospectus, before purchasing our securities. The occurrence of any of these risks could have a material adverse effect on our business, financial condition, results of operations and future prospects. In these circumstances, the market price of our Common Shares could decline, and you may lose all or part of your investment. These risks are not the only risks we face; risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition and results of operations. Investors should also refer to the other information set forth or incorporated by reference in this prospectus supplement and the accompanying prospectus, including our consolidated financial statements and related notes. This prospectus supplement also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors. See the section titled “Cautionary Note Regarding Forward-Looking Statements.”

CONSOLIDATED FINANCIAL INFORMATION AND CURRENCY

Our consolidated financial statements incorporated by reference in this prospectus supplement have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, and are reported in United States dollars.

In this prospectus supplement, where applicable, and unless otherwise indicated, amounts are converted from Canadian dollars to U.S. dollars and vice versa by applying the closing rate of exchange for conversion of one Canadian dollar to U.S. dollars as reported by the Bank of Canada on April 4, 2018.

The following table sets forth for each period indicated: (i) the exchange rates in effect at the end of the period; (ii) the high and low exchange rates during such period; and (iii) the average exchange rates for such period, for one Canadian dollar, expressed in U.S. dollars, as quoted by the Bank of Canada.

| Year Ended December 31 | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| US$ | US$ | US$ | ||||||||||

| Closing |

0.7971 | 0.7448 | 0.7225 | |||||||||

| High |

0.8245 | 0.7972 | 0.8527 | |||||||||

| Low |

0.7276 | 0.6854 | 0.7148 | |||||||||

| Average |

0.7708 | 0.7548 | 0.7820 | |||||||||

On April 4, 2018, the closing exchange rate as quoted by the Bank of Canada was CDN$1.00 = US$0.7807.

Since December 31, 2017, the date of our most recently filed annual audited financial statements, there have been no changes in our share capital on a consolidated basis other than as outlined under “Prior Sales.” For information on the exercise of options pursuant to our incentive stock option plan, and the exercise of certain outstanding warrants, see the section titled “Prior Sales.”

S-11

The Common Shares are listed on the TSX in Canada (trading symbol: AUP) and on Nasdaq in the United States (trading symbol: AUPH).

The following table sets forth, for the periods indicated, the reported high and low prices (in Canadian dollars) and volume of Common Shares traded for each month on the TSX.

TSX

| Price Range (CDN$) | Total Volume | |||||||||||

| Month |

High | Low | ||||||||||

| March, 2017 |

$ | 14.17 | $ | 4.80 | 12,279,153 | |||||||

| April, 2017 |

$ | 10.60 | $ | 8.65 | 2,649,488 | |||||||

| May, 2017 |

$ | 11.07 | $ | 7.75 | 2,062,784 | |||||||

| June, 2017 |

$ | 9.09 | $ | 7.81 | 962,381 | |||||||

| July, 2017 |

$ | 9.75 | $ | 7.80 | 1,418,472 | |||||||

| August, 2017 |

$ | 8.21 | $ | 7.20 | 711,171 | |||||||

| September, 2017 |

$ | 8.57 | $ | 7.50 | 978,676 | |||||||

| October, 2017 |

$ | 9.50 | $ | 7.04 | 1,613,476 | |||||||

| November, 2017 |

$ | 7.59 | $ | 6.00 | 1,693,411 | |||||||

| December, 2017 |

$ | 6.81 | $ | 5.68 | 917,741 | |||||||

| January, 2018 |

$ | 7.58 | $ | 5.70 | 1,344,258 | |||||||

| February, 2018 |

$ | 7.32 | $ | 5.98 | 854,513 | |||||||

| March, 2018 |

$ | 7.82 | $ | 6.49 | 973,583 | |||||||

| April 1 - 4, 2018(1) |

$ | 6.79 | $ | 6.44 | 70,786 | |||||||

| (1) | April 4, 2018 was the last trading day prior to the date of this prospectus supplement. |

The following table sets forth, for the periods indicated, the reported high and low prices (in United States dollars) and the volume of shares traded for each month on Nasdaq.

NASDAQ

| Price Range (US$) | Total Volume | |||||||||||

| Month |

High | Low | ||||||||||

| March, 2017 |

$ | 10.54 | $ | 3.58 | 421,107,989 | |||||||

| April, 2017 |

$ | 7.86 | $ | 6.42 | 102,463,110 | |||||||

| May, 2017 |

$ | 8.19 | $ | 5.74 | 74,595,039 | |||||||

| June, 2017 |

$ | 6.87 | $ | 5.89 | 34,543,620 | |||||||

| July, 2017 |

$ | 7.68 | $ | 6.17 | 35,665,295 | |||||||

| August, 2017 |

$ | 6.62 | $ | 5.66 | 21,374,588 | |||||||

| September, 2017 |

$ | 7.08 | $ | 6.10 | 19,202,130 | |||||||

| October, 2017 |

$ | 7.60 | $ | 5.54 | 39,120,821 | |||||||

| November, 2017 |

$ | 5.92 | $ | 4.68 | 17,378,314 | |||||||

| December, 2017 |

$ | 5.36 | $ | 4.41 | 21,669,860 | |||||||

| January, 2018 |

$ | 6.11 | $ | 4.52 | 22,658,500 | |||||||

| February, 2018 |

$ | 5.77 | $ | 4.76 | 12,473,400 | |||||||

| March , 2018 |

$ | 5.99 | $ | 5.05 | 14,836,900 | |||||||

| April 1 - April 4, 2018(1) |

$ | 5.29 | $ | 5.01 | 1,728,835 | |||||||

| (1) | April 4, 2018 was the last trading day prior to the date of this prospectus supplement. |

S-12

Common Shares

The following table summarizes details of the Common Shares we issued during the 12 month period prior to April 5, 2018.

| Month of Issuance |

Security |

Price per Security |

Number of Securities |

|||||

| April 6, 2017 |

Stock Options1 | CDN$3.91 | 1,500 | |||||

| April 10, 2017 |

Stock Options1 | US$3.50 | 110,000 | |||||

| April 13, 2017 |

Warrants2 | US$3.00 | 1,250 | |||||

| April 25, 2017 |

Stock Options1 | CDN$3.50 | 150,000 | |||||

| May 1, 2017 |

Warrants3 | US$ 3.00 | 748,805 | |||||

| May 8, 2017 |

Stock Options1 | US$3.50 | 10,000 | |||||

| May 9, 2017 |

Stock Options1 | CDN$3.50 | 150,000 | |||||

| May 18, 2017 |

Stock Options1 | US$3.50 | 150,000 | |||||

| May 19, 2017 |

Stock Options1 | CDN$3.91 | 417 | |||||

| May 19, 2017 |

Stock Options1 | CDN$4.21 | 222 | |||||

| May 25, 2017 |

Warrants2 | US$3.00 | 5,000 | |||||

| June 21, 2017 |

Stock Options1 | CDN$3.50 | 20,000 | |||||

| June 23, 2017 |

Stock Options1 | CDN$3.50 | 20,000 | |||||

| June 23, 2017 |

Stock Options1 | CDN$3.66 | 16,399 | |||||

| June 28, 2017 |

Stock Options1 | CDN$3.91 | 500 | |||||

| June 28, 2017 |

Stock Options1 | CDN$4.21 | 500 | |||||

| July 4, 2017 |

Warrants2 | US$2.77 | 7,415 | |||||

| July 25, 2017 |

Warrants4 | US$3.00 | 10,810 | |||||

| July 28, 2017 |

Stock Options1 | CDN$4.31 | 20,000 | |||||

| July 28 ,2017 |

Stock Options1 | CDN$3.96 | 10,000 | |||||

| July 28, 2017 |

Stock Options1 | CDN$4.73 | 1,667 | |||||

| September 12, 2017 |

Stock Options1 | CDN$3.20 | 437,444 | |||||

| October 5, 2017 |

Stock Options1 | CDN$3.50 | 20,000 | |||||

| October 19, 2017 |

Warrants5 | US$ 3.00 | 59,091 | |||||

|

|

|

|||||||

| Total |

1,951,020 | |||||||

|

|

|

|||||||

Note:

| 1 | Issued upon exercise of previously issued Stock Options. |

| 2 | Issued upon exercise of previously issued Warrants. |

| 3 | Issued pursuant to a cashless exercise provision. Calculation was determined by the number of warrants to be exercised (1,364,380) multiplied by a five day weighted average market price $US 7.14 less the exercise price ($US 3.2204) with the difference divided by the weighted average market price. |

| 4 | Issued pursuant to a cashless exercise provision. Calculation was determined by the number of warrants to be exercised (19,800) multiplied by a five day weighted average market price $US 7.09 less the exercise price ($US 3.2204) with the difference divided by the weighted average market price. |

| 5 | Issued pursuant to a cashless exercise provision. Calculation was determined by the number of warrants to be exercised (111,200) multiplied by a five day weighted average market price $US 6.94 less the exercise price ($US3.2204) with the difference divided by the weighted average market price. |

S-13

Stock Options

The following table summarizes details of the stock options we granted during the 12 month period prior to April 5, 2018.

| Month of Grant |

Security |

Grant Price per Security (CDN$) |

Number of Securities |

|||||

| April 26, 2017 |

Stock Options | 9.45 | 333,000 | |||||

| June 23, 2017 |

Stock Options | 8.48 | 50,000 | |||||

| July 5, 2017 |

Stock Options | 8.10 | 280,000 | |||||

| September 20, 2017 |

Stock Options | 7.59 | 60,000 | |||||

| October 25, 2017 |

Stock Options | 7.30 | 5,000 | |||||

| November 20, 2017 |

Stock Options | 6.56 | 30,000 | |||||

| February 1, 2018 |

Stock Options | 6.52 | 2,178,000 | |||||

| February 5, 2018 |

Stock Options | 6.42 | 550,000 | |||||

| February 9, 2018 |

Stock Options | 6.40 | 50,000 | |||||

| February 22, 2018 |

Stock Options | 6.92 | 50,000 | |||||

| March 21, 2018 |

Stock Options | 7.06 | 150,000 | |||||

|

|

|

|||||||

| Total |

3,736,000 | |||||||

|

|

|

|||||||

The proceeds from the sale or other disposition of the Registrable Common Shares covered by this prospectus supplement are solely for the account of the Warrant holders. Accordingly, we will not receive any proceeds from the sale or other disposition of the Registrable Common Shares by the Warrant holders. The net proceeds received from the sale or other disposition of the Registrable Common Shares by the Warrant holders, if any, is unknown.

Common Shares

We are authorized to issue an unlimited number of Common Shares, without nominal or par value. As of April 4, 2018, 84,051,758 Common Shares are issued and outstanding. In addition, 6,433,181 Common Shares are reserved for issuance upon exercise of existing warrants and 7,841,690 Common Shares have been reserved for issuance pursuant to outstanding options.

The holders of Common Shares are entitled to one (1) vote per share held at meetings of shareholders, to receive such dividends as declared by us and to receive a share of our remaining property and assets upon our dissolution or winding up. The Common Shares are not subject to any future call or assessment and there are no pre-emptive, conversion or redemption rights attached to such shares.

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following discussion describes the material U.S. federal income tax consequences relating to the ownership and disposition of common shares by U.S. Holders (as defined below). This discussion applies to U.S. Holders that purchase common shares pursuant to the offering and hold such common shares as capital assets. This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations promulgated thereunder and administrative and judicial interpretations thereof, all as in effect on the

S-14

date hereof and all of which are subject to change, possibly with retroactive effect. This discussion does not address all of the U.S. federal income tax consequences that may be relevant to specific U.S. Holders in light of their particular circumstances or to U.S. Holders subject to special treatment under U.S. federal income tax law (such as certain financial institutions, insurance companies, broker-dealers and traders in securities or other persons that generally mark their securities to market for U.S. federal income tax purposes, tax-exempt entities, retirement plans, regulated investment companies, real estate investment trusts, certain former citizens or residents of the United States, persons who hold common shares as part of a “straddle,” “hedge,” “conversion transaction,” “synthetic security” or integrated investment, persons subject to Section 451(b) of the Code, persons that have a “functional currency” other than the U.S. dollar, persons that own directly, indirectly or through attribution 10% or more of the voting power or value of our shares, corporations that accumulate earnings to avoid U.S. federal income tax, partnerships and other pass-through entities, and investors in such pass-through entities). This discussion does not address any U.S. state or local or non-U.S. tax consequences or any U.S. federal estate, gift or alternative minimum tax consequences.

As used in this discussion, the term “U.S. Holder” means a beneficial owner of common shares that is, for U.S. federal income tax purposes, (1) an individual who is a citizen or resident of the United States, (2) a corporation (or entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof, or the District of Columbia, (3) an estate the income of which is subject to U.S. federal income tax regardless of its source or (4) a trust (x) with respect to which a court within the United States is able to exercise primary supervision over its administration and one or more United States persons have the authority to control all of its substantial decisions or (y) that has elected under applicable U.S. Treasury regulations to be treated as a domestic trust for U.S. federal income tax purposes.

If an entity treated as a partnership for U.S. federal income tax purposes holds common shares, the U.S. federal income tax consequences relating to an investment in the common shares will depend in part upon the status and activities of such entity and the particular partner. Any such entity should consult its own tax advisor regarding the U.S. federal income tax consequences applicable to it and its partners of the purchase, ownership and disposition of common shares.

Persons considering an investment in common shares should consult their own tax advisors as to the particular tax consequences applicable to them relating to the purchase, ownership and disposition of common shares, including the applicability of U.S. federal, state and local tax laws and non-U.S. tax laws.

Passive Foreign Investment Company Consequences

In general, a corporation organized outside the United States will be treated as a passive foreign investment company (a “PFIC”), for any taxable year in which either (1) at least 75% of its gross income is “passive income” (the “PFIC income test”), or (2) on average at least 50% of its assets, determined on a quarterly basis, are assets that produce passive income or are held for the production of passive income (the “PFIC asset test”). Passive income for this purpose generally includes, among other things, dividends, interest, royalties, rents, and gains from the sale or exchange of property that gives rise to passive income. Assets that produce or are held for the production of passive income generally include cash, even if held as working capital or raised in a public offering, marketable securities, and other assets that may produce passive income. Generally, in determining whether a non-U.S. corporation is a PFIC, a proportionate share of the income and assets of each corporation in which it owns, directly or indirectly, at least a 25% interest (by value) is taken into account.

We do not believe we were a PFIC for the year ended December 31, 2017. While we also do not believe we will be a PFIC for the current taxable year, because PFIC status is determined on an annual basis and generally cannot be determined until the end of the taxable year, there can be no assurance that we will not be a PFIC for the current taxable year. Because we hold a substantial amount of cash and cash equivalents, and because the calculation of the value of our assets may be based in part on the value of common shares, which may fluctuate considerably, we may also be a PFIC in future taxable years under the PFIC asset test. Even if we determine that

S-15

we are not a PFIC for a taxable year, there can be no assurance that the IRS will agree with our conclusion and that the IRS would not successfully challenge our position. Our status as a PFIC is a fact-intensive determination made on an annual basis. Accordingly, our U.S. counsel expresses no opinion with respect to our PFIC status and also expresses no opinion with regard to our expectations regarding our PFIC status.

If we are a PFIC in any taxable year during which a U.S. Holder owns common shares, the U.S. Holder could be liable for additional taxes and interest charges under the “PFIC excess distribution regime” upon (1) a distribution paid during a taxable year that is greater than 125% of the average annual distributions paid in the three preceding taxable years, or, if shorter, the U.S. Holder’s holding period for the common shares, and (2) any gain recognized on a sale, exchange or other disposition, including a pledge, of the common shares, whether or not we continue to be a PFIC. Under the PFIC excess distribution regime, the tax on such distribution or gain would be determined by allocating the distribution or gain ratably over the U.S. Holder’s holding period for common shares. The amount allocated to the current taxable year (i.e., the year in which the distribution occurs or the gain is recognized) and any year prior to the first taxable year in which we are a PFIC will be taxed as ordinary income earned in the current taxable year. The amount allocated to other taxable years will be taxed at the highest marginal rates in effect for individuals or corporations, as applicable, to ordinary income for each such taxable year, and an interest charge, generally applicable to underpayments of tax, will be added to the tax.

If we are a PFIC for any year during which a U.S. Holder holds common shares, we must generally continue to be treated as a PFIC by that holder for all succeeding years during which the U.S. Holder holds the common shares, unless we cease to meet the requirements for PFIC status and the U.S. Holder makes a “deemed sale” election with respect to the common shares. If the election is made, the U.S. Holder will be deemed to sell the common shares it holds at their fair market value on the last day of the last taxable year in which we qualified as a PFIC, and any gain recognized from such deemed sale would be taxed under the PFIC excess distribution regime. After the deemed sale election, the U.S. Holder’s common shares would not be treated as shares of a PFIC unless we subsequently become a PFIC.

If we are a PFIC for any taxable year during which a U.S. Holder holds common shares and one of our non-U.S. corporate subsidiaries is also a PFIC (i.e., a lower-tier PFIC), such U.S. Holder would be treated as owning a proportionate amount (by value) of the shares of the lower-tier PFIC and would be taxed under the PFIC excess distribution regime on distributions by the lower-tier PFIC and on gain from the disposition of shares of the lower-tier PFIC even though such U.S. Holder would not receive the proceeds of those distributions or dispositions. Each U.S. Holder is advised to consult its tax advisors regarding the application of the PFIC rules to our non-U.S. subsidiaries.

If we are a PFIC, a U.S. Holder will not be subject to tax under the PFIC excess distribution regime on distributions or gain recognized on common shares if such U.S. Holder makes a valid “mark-to-market” election for our common shares. A mark-to-market election is available to a U.S. Holder only for “marketable stock.” Our common shares will be marketable stock as long as they remain listed on the NASDAQ and are regularly traded, other than in de minimis quantities, on at least 15 days during each calendar quarter. If a mark-to-market election is in effect, a U.S. Holder generally would take into account, as ordinary income each year, the excess of the fair market value of common shares held at the end of such taxable year over the adjusted tax basis of such common shares. The U.S. Holder would also take into account, as an ordinary loss each year, the excess of the adjusted tax basis of such common shares over their fair market value at the end of the taxable year, but only to the extent of the excess of amounts previously included in income over ordinary losses deducted as a result of the mark-to-market election. The U.S. Holder’s tax basis in common shares would be adjusted to reflect any income or loss recognized as a result of the mark-to-market election. Any gain from a sale, exchange or other disposition of common shares in any taxable year in which we are a PFIC would be treated as ordinary income and any loss from such sale, exchange or other disposition would be treated first as ordinary loss (to the extent of any net mark-to-market gains previously included in income) and thereafter as capital loss.

S-16

A mark-to-market election will not apply to common shares for any taxable year during which we are not a PFIC, but will remain in effect with respect to any subsequent taxable year in which we become a PFIC. Such election will not apply to any non-U.S. subsidiaries that we may organize or acquire in the future. Accordingly, a U.S. Holder may continue to be subject to tax under the PFIC excess distribution regime with respect to any lower-tier PFICs that we may organize or acquire in the future notwithstanding the U.S. Holder’s mark-to-market election for the common shares.

The tax consequences that would apply if we are a PFIC would also be different from those described above if a U.S. Holder were able to make a valid qualified electing fund (“QEF”) election. At this time we do not expect to provide U.S. Holders with the information necessary for a U.S. Holder to make a QEF election, and therefore prospective investors should assume that a QEF election will not be available.

Each U.S. person that is an investor of a PFIC is generally required to file an annual information return on IRS Form 8621 containing such information as the U.S. Treasury Department may require. The failure to file IRS Form 8621 could result in the imposition of penalties and the extension of the statute of limitations with respect to U.S. federal income tax.

The U.S. federal income tax rules relating to PFICs are very complex. Prospective U.S. investors are strongly urged to consult their own tax advisors with respect to the impact of PFIC status on the purchase, ownership and disposition of common shares, the consequences to them of an investment in a PFIC, any elections available with respect to the common shares and the IRS information reporting obligations with respect to the purchase, ownership and disposition of common shares of a PFIC.

Distributions

Subject to the discussion above under “Passive Foreign Investment Company Consequences,” a U.S. Holder that receives a distribution with respect to common shares generally will be required to include the gross amount of such distribution (before reduction for any Canadian withholding taxes withheld therefrom) in gross income as a dividend when actually or constructively received to the extent of the U.S. Holder’s pro rata share of our current and/or accumulated earnings and profits (as determined under U.S. federal income tax principles). To the extent a distribution received by a U.S. Holder is not a dividend because it exceeds the U.S. Holder’s pro rata share of our current and accumulated earnings and profits, it will be treated first as a tax-free return of capital and reduce (but not below zero) the adjusted tax basis of the U.S. Holder’s common shares. To the extent the distribution exceeds the adjusted tax basis of the U.S. Holder’s common shares, the remainder will be taxed as capital gain. Because we may not account for our earnings and profits in accordance with U.S. federal income tax principles, U.S. Holders should expect all distributions to be reported to them as dividends. Distributions on common shares that are treated as dividends generally will constitute income from sources outside the United States for foreign tax credit purposes and generally will constitute passive category income. Such dividends will not be eligible for the “dividends received” deduction generally allowed to corporate shareholders with respect to dividends received from U.S. corporations.

Dividends paid by a “qualified foreign corporation” are eligible for taxation at a reduced capital gains rate rather than the marginal tax rates generally applicable to ordinary income provided that certain requirements are met. However, if we are a PFIC for the taxable year in which the dividend is paid or the preceding taxable year (see discussion above under “Passive Foreign Investment Company Consequences”), we will not be treated as a qualified foreign corporation, and therefore the reduced capital gains tax rate described above will not apply. Each U.S. Holder is advised to consult its tax advisors regarding the availability of the reduced tax rate on dividends with regard to its particular circumstances.

A non-United States corporation (other than a corporation that is classified as a PFIC for the taxable year in which the dividend is paid or the preceding taxable year) generally will be considered to be a qualified foreign corporation (a) if it is eligible for the benefits of a comprehensive tax treaty with the United States which the

S-17

Secretary of Treasury of the United States determines is satisfactory for purposes of this provision and which includes an exchange of information provision, or (b) with respect to any dividend it pays on common shares that are readily tradable on an established securities market in the United States. We believe that we qualify as a resident of Canada for purposes of, and are eligible for the benefits of, the U.S.-Canada Treaty, although there can be no assurance in this regard. Further, the IRS has determined that the U.S.-Canada Treaty is satisfactory for purposes of the qualified dividend rules and that it includes an exchange of information provision. Therefore, subject to the discussion above under “Passive Foreign Investment Company Consequences,” if the U.S.-Canada Treaty is applicable, such dividends will generally be “qualified dividend income” in the hands of individual U.S. Holders, provided that certain conditions are met.

Sale, Exchange or Other Disposition of Common Shares

Subject to the discussion above under “Passive Foreign Investment Company Consequences,” a U.S. Holder generally will recognize capital gain or loss for U.S. federal income tax purposes upon the sale, exchange or other disposition of common shares in an amount equal to the difference, if any, between the amount realized (i.e., the amount of cash plus the fair market value of any property received) on the sale, exchange or other disposition and such U.S. Holder’s adjusted tax basis in the common shares. Such capital gain or loss generally will be long-term capital gain taxable at a reduced rate for non-corporate U.S. Holders or long-term capital loss if, on the date of sale, exchange or other disposition, the common shares were held by the U.S. Holder for more than one year. Any capital gain of a non-corporate U.S. Holder that is not long-term capital gain is taxed at ordinary income rates. The deductibility of capital losses is subject to limitations. Any gain or loss recognized from the sale or other disposition of common shares will generally be gain or loss from sources within the United States for U.S. foreign tax credit purposes.

Medicare Tax

Certain U.S. Holders that are individuals, estates or trusts and whose income exceeds certain thresholds generally are subject to a 3.8% tax on all or a portion of their net investment income, which may include their gross dividend income and net gains from the disposition of common shares. If you are a United States person that is an individual, estate or trust, you are encouraged to consult your tax advisors regarding the applicability of this Medicare tax to your income and gains in respect of your investment in common shares.

Information Reporting and Backup Withholding

U.S. Holders may be required to file certain U.S. information reporting returns with the IRS with respect to an investment in common shares, including, among others, IRS Form 8938 (Statement of Specified Foreign Financial Assets). As described above under “Passive Foreign Investment Company Consequences”, each U.S. Holder who is a shareholder of a PFIC must file an annual report containing certain information. U.S. Holders paying more than US$100,000 for common shares may be required to file IRS Form 926 (Return by a U.S. Transferor of Property to a Foreign Corporation) reporting this payment. Substantial penalties may be imposed upon a U.S. Holder that fails to comply with the required information reporting.