YOUR VOTE IS IMPORTANT. THE BOARD OF AURINIA RECOMMENDS VOTING THE YELLOW PROXY: | |

| FOR fixing the number of directors at eight |

| FOR the election of Aurinia’s nominees for directors |

| FOR the appointment of PricewaterhouseCoopers LLP as auditor |

| FOR the approval of an advisory “Say on Pay” vote |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

1. | to fix the number of directors at eight; |

2. | to elect the directors for the ensuing year; |

3. | to receive the audited consolidated financial statements of the Company for the financial year ended December 31, 2018, and the report of the auditors thereon; |

4. | to re-appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditors of the Company; |

5. | to consider a non-binding advisory "say on pay" resolution regarding the Company’s approach to executive compensation; and |

6. | to transact such further and other business as may properly be brought before the Meeting or any adjournment thereof. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

2 | |

2 | |

3 | |

3 | |

5 | |

6 | |

6 | |

15 | |

15 | |

17 | |

18 | |

18 | |

36 | |

40 | |

43 | |

44 | |

44 | |

45 | |

46 | |

46 | |

47 | |

47 | |

49 | |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

a. | FOR fixing the number of directors at eight; |

b. | FOR the election of each of the nominees for election as a Director of the Company set forth in this Circular; |

c. | FOR the re-appointment of PricewaterhouseCoopers LLP, Chartered Professional Accountants, as auditors of the Company; and |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

d. | FOR the approval of a non-binding advisory "say on pay" resolution regarding the Company’s approach to executive compensation. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Name | Number of Common Shares | Percentage of Class | ||

ILJIN Group* | 13,716,567 | 14.94% | ||

* | Common Shares held by ILJIN, ILJIN STEEL Co., Ltd. and ILJIN Semiconductor Co., Ltd. This information was taken from the Schedule 13D filing of ILJIN, ILJIN Semiconductor Co., Ltd., ILJIN Steel Co., Ltd., ILJIN C&S Co. Ltd., Sae Kyoung Huh and Chin Kyu Huh dated April 8, 2019. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(i) | FOR fixing the number of directors at eight; and |

(ii) | FOR the election of each of the nominees to the Board set forth in this Circular, |

Name, province or state, and country of residence | Age (at May 9, 2019) | Present Principal Occupation | Position with the Company | Period During Which Served as a Director | Number of Common Shares Beneficially Owned, Controlled or Directed | No. of Securities Underlying Unexercised Stock Options |

Dr. George M. Milne, Jr. (3) Boca Grande, Florida United States | 75 | Venture Partner at Radius Ventures LLC, a venture capitalist firm; Lead Director at Charles River Laboratories, a pre-clinical and clinical laboratory services corporation; and Director of Amylyx Pharmaceuticals, Inc., a pharmaceutical company | Director, Chairman of the Board | Since May 8, 2017 | Nil | 80,000 |

Mr. Peter Greenleaf Bethesda, Maryland United States | 49 | Chief Executive Officer ("CEO") of the Company | Director and CEO | CEO and Director since April 29, 2019 | Nil | 1,600,000 |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Name, province or state, and country of residence | Age (at May 9, 2019) | Present Principal Occupation | Position with the Company | Period During Which Served as a Director | Number of Common Shares Beneficially Owned, Controlled or Directed | No. of Securities Underlying Unexercised Stock Options |

Dr. David R.W. Jayne(3)(4) Cambridge United Kingdom | 62 | Professor of Clinical Autoimmunity in the Department of Medicine at the University of Cambridge, UK; fellow of the Royal Colleges of Physicians of London and Edinburgh, and the Academy of Medical Science; certified nephrologist and an Honorary Consultant Physician at Addenbrooke’s Hospital, Cambridge UK; medical advisor to UK, U.S. and EU regulatory bodies, patient groups and professional organizations; elected the first President of the European Vasculitis Society in 2011; member of the ERA-EDTA immunopathology working group; co-chair of the EULAR/ERA-EDTA task force on lupus nephritis | Director | Since May 26, 2015 | Nil | 90,000 |

Dr. Hyuek Joon ("Joon") Lee(1)(2)(3) Seoul, Korea | 52 | Managing Director of Business Development, ILJIN Group | Director | Since May 26, 2015 | Nil | 90,000 |

Mr. Joseph P. Hagan La Jolla, California United States | 50 | President and CEO of Regulus Therapeutics Inc., a biopharmaceutical company | Director | Since February 7, 2018 | Nil | 50,000 |

Dr. Michael Hayden(4) Vancouver, British Columbia Canada | 67 | Director, Translational Laboratory in Genetic Medicine (TLGM), Agency for Science, Technology and Research (A*STAR), Singapore; Distinguished Professor, National University of Singapore; Killam Professor (Highest recognition), University of British Columbia, Vancouver, BC; Canada Research Chair, Human Genetics and Molecular Medicine; Senior Scientist, Centre for Molecular Medicine and Therapeutics, Vancouver, BC; Professor, Department of Medical Genetics, University of British Columbia, Vancouver, BC | Director | Since February 21, 2018 | Nil | 50,000 |

Dr. Daniel G. Billen Mississauga, Ontario Canada | 66 | Retired, previously commercial GM/VP at Amgen Inc. | Director | Since April 29, 2019 | 20,000 | 50,000 |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Name, province or state, and country of residence | Age (at May 9, 2019) | Present Principal Occupation | Position with the Company | Period During Which Served as a Director | Number of Common Shares Beneficially Owned, Controlled or Directed | No. of Securities Underlying Unexercised Stock Options |

Mr. R. Hector MacKay-Dunn, Q.C. [Vancouver, British Columbia Canada] | 68 | Senior Partner, Farris, Vaughan, Wills & Murphy | none | n/a | Nil | Nil |

(1) | Member of the Audit Committee of the Company. |

(2) | Member of the Compensation Committee of the Company. |

(3) | Member of the Governance & Nomination Committee of the Company. |

(4) | Member of the Standing Research Committee of the Company. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Dr. George M. Milne, Jr. | Mr. Peter Greenleaf | Dr. Hyuek Joon Lee | Dr. David R.W. Jayne | Mr. Joseph P. Hagan | Dr. Michael Hayden | Dr. Daniel G. Billen | Mr. R. Hector MacKay-Dunn | |

Management/operations | √ | √ | √ | √ | √ | √ | ||

CEO/CFO/COO experience | √ | √ | √ | |||||

Industry experience | √ | √ | √ | √ | √ | √ | √ | |

Commercialization | √ | √ | √ | √ | ||||

Manufacturing/supply chain | √ | √ | √ | |||||

Government relations | √ | |||||||

Finance/financial industry | √ | |||||||

Accounting/auditing | √ | |||||||

Risk management | √ | √ | √ | |||||

Strategy development | √ | √ | √ | √ | √ | √ | √ | √ |

Mergers & acquisitions | √ | √ | √ | √ | √ | √ | ||

Legal/regulatory | √ | √ | √ | |||||

Corporate governance | √ | √ | √ | √ | ||||

Capital markets | √ | √ | √ | |||||

Executive compensation | √ | √ | √ | √ | √ | |||

Information technology | √ | √ | ||||||

Research/development | √ | √ | √ | √ | ||||

Clinical development | √ | √ | √ | √ | ||||

Business development | √ | √ | √ | √ | √ | |||

(a) | is, as at the date of this Circular, or has been, within ten years before the date of this Circular, a director, CEO or Chief Financial Officer ("CFO") of any company, that: |

(i) | was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation that was issued while the proposed director was acting in the capacity as director, CEO or CFO that was in effect for a period of more than 30 consecutive days; or |

(ii) | was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation that was issued after the proposed director ceased to be a director, CEO or CFO and which resulted from an event that occurred while that |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(b) | is, as at the date of this Circular, or has been within ten years before the date of this Circular, a director or executive officer of any company, that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; |

(c) | has, within the ten years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets; or |

(d) | has been subject to: |

(i) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

(ii) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director. |

Director | Board | Audit | Compensation | Governance | Research | Total Attendance |

Dr. Richard Glickman | 10 of 10 | N/A | N/A | N/A | N/A | 10/10 (100%) |

Dr. Benjamin Rovinski | 10 of 10 | 4 of 4 | 3 of 3 | N/A | N/A | 17/17 (100%) |

Dr. Joon Lee | 10 of 10 | 4 of 4 | 3 of 3 | 1 of 1 | N/A | 18/18 (100%) |

Dr. David Jayne | 10 of 10 | N/A | N/A | 1 of 1 | 2 of 2 | 13/13 (100%) |

Mr. Jeff Randall | 10 of 10 | 4 of 4 | 3 of 3 | N/A | N/A | 17/17 (100%) |

Dr. George M. Milne, Jr. | 9 of 10 | N/A | N/A | 1 of 1 | N/A | 10/11 (91%) |

Mr. Joseph P. Hagan(1) | 8 of 8 | N/A | N/A | N/A | N/A | 8/8 (100%) |

Dr. Michael Hayden(2) | 8 of 8 | N/A | N/A | N/A | 2 of 2 | 10/10 (100%) |

Attendance Rate: | 98.7% | 100% | 100% | 100% | 100% | 103/104 (99.0%) |

(1) | Joseph P Hagan was appointed as a Director on February 7, 2018. |

(2) | Michael Hayden was appointed as a Director on February 21, 2018. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Name | Name of Issuer | Name of Exchange of Market |

Mr. Peter Greenleaf | Cerecor, Inc. Antares Pharma, Inc. BioDelivery Sciences International, Inc. Eyegate Pharmaceuticals, Inc. | NASDAQ:CERC NASDAQ;ATRS NASDAQ:BDSI NASDAQ:EYEG |

Dr. George Milne, Jr. | Charles River Laboratories International, Inc. | NYSE:CRL |

Mr. Joseph P. Hagan | Zosano Pharma Corporation Regulus Therapeutics Inc. | NASDAQ:ZSAN NASDAQ:RGLS |

Dr. Michael Hayden | Xenon Pharmaceuticals Inc. | NASDAQ:XENE |

Mr. R. Hector MacKay-Dunn | Copper Fox Metals Inc. | TSXV:CUU |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Fiscal year ended | 2018 | % of Total Fees | 2017 | % of Total Fees | |||||||||

Audit fees (for audit of the Company’s annual financial statements and services provided in connection with statutory and regulatory filings)(1) | $ | 95,124 | 31.5 | % | $ | 130,583 | 50.2 | % | |||||

Audit related fees, including review of the Company’s quarterly financial statements(2) | $ | 40,825 | 13.5 | % | $ | 37,491 | 14.4 | % | |||||

Tax fees (tax compliance, tax advice and planning)(3) | $ | 110,496 | 36.6 | % | $ | 44,935 | 17.3 | % | |||||

All other fees(4) | $ | 55,647 | 18.4 | % | $ | 46,943 | 18.1 | % | |||||

Total fees | $ | 302,092 | 100.0 | % | $ | 259,952 | 100.0 | % | |||||

(1) | These fees include professional services provided by the external auditor for the statutory audits of the annual financial statements. The total for 2018 is comprised of $56,910 related to interim billings for the 2018 audit and $38,214 related to fees for the 2017 audit billed in 2018. The total for 2017 is comprised of $61,688 related to interim billings for the 2017 audit and $68,895 related to fees for the 2016 audit billed in 2017. |

(2) | These fees relate to performing review engagement services on the Company’s quarterly financial statements and other audit related services. |

(3) | These fees include professional services for transfer pricing, tax compliance, tax advice, tax planning and various taxation matters. |

(4) | These fees for 2018 include professional services for assistance in filing the short form base shelf prospectus from March 2018, the prospectus supplement related to the re-sale of Common Shares, the at-the-market prospectus supplement and various other advisory services. These fees for 2017 include professional services for assistance in filing prospectus supplements for the December 2016 bought deal financing and the March 20, 2017 public offering, and a preliminary short form base shelf prospectus. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

• | Dr. Benjamin Rovinski, the Chair of the Compensation Committee, has served on the Boards of several biotechnology companies for the past 15 years, and he has been a member of numerous compensation and audit committees. Dr. Rovinski also was responsible for the design and implementation of benefit programs and compensation of senior non-executive employees in his previous capacity as Senior Scientist and Head of the Molecular Virology Department at Sanofi Pasteur. In that leadership role, he also oversaw global project teams and implemented various performance management systems for the evaluation of corporate and strategic objectives and performance of senior level project team members. |

• | Dr. Joon Lee has served as director and managing director in a number of companies in Korea, where he participated in the processes of evaluating corporate objectives and performance reviews of senior level managers and employees. As of October 2014, he joined the board of directors of Life Science Enterprises in Massachusetts, a privately held company focusing on advanced biomaterials that promote bone repair, and oversaw performance reviews, compensation and benefit packages of the senior management. In addition, his experience as a founding member of an information technology start-up grants him added insight into the dynamics of early stage companies. |

• | Mr. Jeff Randall has over 30 years of experience serving in financial and operating roles spanning biotechnology, pharmaceuticals and manufacturing. He has led a number of companies through multi-million-dollar financings and mergers and acquisitions. In addition to his current board positions, Mr. Randall served on the board of directors of Nanosphere, Inc. from 2008 to 2016, most recently as Chairman of the Board. From 2004 to 2006, Mr. Randall, a financial consultant, was Senior Vice President and Chief Financial Officer of Eximias Pharmaceutical Corporation, a development-stage drug development company. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

• | assist the Company in attracting and retaining talented executives; |

• | provide a strong incentive for executives and key employees to work toward achievement of the Company’s goals and strategic objectives; |

• | align management’s interests with those of Shareholders and other stakeholders; |

• | motivate executives towards the enhancement of long-term Shareholder value; and |

• | be competitive with other companies of similar size and business. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Achaogen Inc. | Calithera Biosciences, Inc. | Reata Pharmaceuticals Inc. |

Aduro Biotech, Inc. | Cara Therapeutics, Inc. | Rigel Pharmaceuticals Inc. |

Alder Biopharmaceuticals Inc. | Concert Pharmaceuticals, Inc. | Sangamo Therapeutics, Inc. |

Abeona Therapeutics Inc. | Cytokinetics Inc. | Sienna Biopharmaceuticals, Inc. |

Akebia Therapeutics, Inc. | Epizyme, Inc. | Seres Therapeutics, Inc. |

Arbutus Biopharma Corp. | Glycomimetics Inc. | Tetraphase Pharmaceuticals Inc. |

Atara Biotherapeutics, Inc. | Kala Pharmaceuticals, Inc. | TG Therapeutics, Inc. |

Axovant Sciences Ltd. | Keryx Biopharmaceuticals Inc. | Xencor Inc. |

Bellicum Pharmaceuticals, Inc. | Karyopharm Therapeutics Inc. | Zogenix, Inc. |

Biohaven Pharmaceutical Holding Co Ltd. | La Jolla Pharmaceutical Co. | |

Acceleron | Bellicum Pharmaceuticals, Inc | Omeros |

Aduro Biotech, Inc. | Biohaven Pharmaceutical Holding Co Ltd. | Paratek |

Aerie | Cara Therapeutics, Inc. | Revance |

Aimmune | Chemocentryx | Seres Therapeutics, Inc. |

Akebia Therapeutics, Inc. | Concert Pharmaceuticals, Inc. | Sienna Biopharmacetuticals, Inc. |

Alder Biopharmaceuticals Inc | Epizyme, Inc. | Tetraphase Pharmaceuticals Inc |

Ardelyx | Glyconimetics Inc | TG Therapeutics, Inc. |

Atara Biotherapeutics, Inc. | Kala Pharmaceuticals, Inc. | |

Axovant Sciences Ltd. | Karyopharm Therapeutics Inc. | |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

a) | Base Salary |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(i) | Clinical and regulatory objectives |

(ii) | Other objectives |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Dr. Richard Glickman | 400,000 |

Mr. Dennis Bourgeault | 150,000 |

Dr. Neil Solomons | 175,000 |

Mr. Michael Martin | 150,000 |

Dr. Robert Huizinga | 225,000 |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

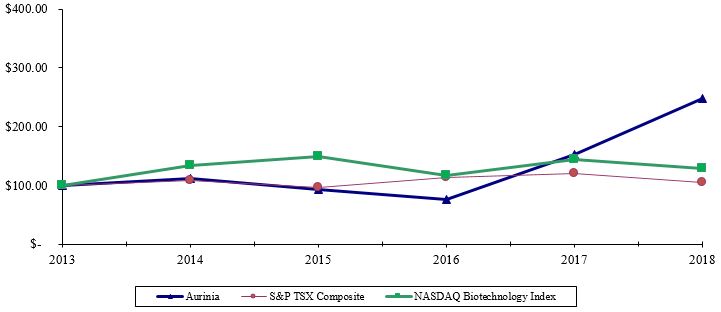

2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

Aurinia | $100.00 | $110.67 | $92.80 | $75.47 | $152.53 | $247.47 |

S&P TSX Composite | $100.00 | $107.64 | $95.70 | $112.46 | $119.41 | $105.36 |

NASDAQ Biotechnology Index | $100.00 | $133.88 | $149.17 | $116.82 | $143.37 | $127.86 |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Name and principal position | Year | Salary ($)(2) | Share-based awards ($) | Option-based awards(3) ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation(17) ($) | Total compensation ($) | |

Annual incentive plans(4) | Long-term incentive plans | ||||||||

Dr. Richard Glickman Chairman, President and CEO(1) | 2018 | 544,250 | Nil | 914,874(5) | 343,000 | Nil | Nil | Nil | 1,802,124 |

2017 | 465,628 | Nil | 2,249,019(10) | 396,568(16) | Nil | Nil | Nil | 3,111,215 | |

2016 | Nil | Nil | Nil | Nil | Nil | Nil | 103,220(18) | 103,220 | |

Mr. Dennis Bourgeault Chief Financial Officer | 2018 | 242,969 | Nil | 351,432(6) | 86,220 | Nil | Nil | Nil | 680,621 |

2017 | 215,528 | Nil | 374,836(11) | 90,956 | Nil | Nil | Nil | 681,320 | |

2016 | 203,175 | Nil | 67,313(15) | 58,126 | Nil | Nil | Nil | 328,614 | |

Dr. Neil Solomons Chief Medical Officer | 2018 | 340,351 | Nil | 410,004(7) | 130,856 | Nil | Nil | Nil | 881,211 |

2017 | 329,375 | Nil | 325,572(12) | 137,233 | Nil | Nil | Nil | 792,180 | |

2016 | 244,939 | Nil | 67,313(15) | 89,864 | Nil | Nil | Nil | 402,116 | |

Dr. Robert Huizinga Executive Vice President, Corporate Development | 2018 | 320,330 | Nil | 527,149(8) | 115,935 | Nil | Nil | Nil | 963,414 |

2017 | 290,312 | Nil | 235,611(13) | 121,880 | Nil | Nil | Nil | 647,803 | |

2016 | 188,125 | Nil | 67,313(15) | 69,340 | Nil | Nil | Nil | 324,778 | |

Mr. Michael Martin Chief Operating Officer | 2018 | 252,688 | Nil | 351,432(9) | 97,882 | Nil | Nil | Nil | 702,002 |

2017 | 231,492 | Nil | 192,773(14) | 101,851 | Nil | Nil | Nil | 526,116 | |

2016 | 218,225 | Nil | 67,313(15) | 62,431 | Nil | Nil | Nil | 347,969 | |

(1) | Dr. Glickman did not receive any additional remuneration relating to his position as a Director or as the Chairman of the Board in 2017 and 2018. Dr. Glickman's 2017 salary was for the period between February 6, 2017 (the date he was appointed Chief Executive Officer) and December 31, 2017. |

(2) | The salaries of the NEOs are paid in Canadian dollars which is converted into US dollars at an average quarterly rate. |

(3) | Calculated as of the grant date using the Black-Scholes option pricing model. The value shown is calculated by multiplying the number of stock options granted by the Canadian dollar exercise price at the time of grant by the Black-Scholes valuation factor and converting the value into US$ using the Bank of Canada closing rate on the date of granting of the options. The value is the same as the accounting fair value of the full grant but is not adjusted by the vesting schedule. |

(4) | The Annual Incentive Plan amounts for each NEO are calculated initially in Canadian dollars and converted into US dollars at the year-end rate. |

(5) | Calculation based on 400,000 options at an exercise price of CDN$6.42; Black-Scholes valuation factor = CDN$2.8314- converted into US$ at a rate of US$1.00 = CDN$1.2379. |

(6) | Calculation based on 150,000 options at an exercise price of CDN$6.52; Black-Scholes valuation factor = CDN$2.8800 - converted into US$ at a rate of US$1.00 = CDN$1.2293. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(7) | Calculation based on 175,000 options at an exercise price of CDN$6.52; Black-Scholes valuation factor = CDN$2.8800 - converted into US$ at a rate of US$1.00 = CDN$1.2293. |

(8) | Calculation based on 225,000 options at an exercise price of CDN$6.52; Black-Scholes valuation factor = CDN$2.8800 - converted into US$ at a rate of US$1.00 = CDN$1.2293. |

(9) | Calculation based on 150,000 options at an exercise price of CDN$6.52; Black-Scholes valuation factor = CDN$2.8800 - converted into US$ at a rate of US$1.00 = CDN$1.2293. |

(10) | Calculation based on 1,050,000 options at an exercise price of CDN$4.21; Black-Scholes valuation factor = CDN$2.8147 - converted into US$ at a rate of US$1.00 = CDN$1.3141. These options were granted in connection with the appointment of Dr. Glickman as the Company’s Chief Executive Officer. |

(11) | Calculation based on 175,000 options at an exercise price of CDN$4.21; Black-Scholes valuation factor = CDN$2.8147 - converted into US$ at a rate of US$1.00 = CDN$1.3141. |

(12) | Calculation based on 152,000 options at an exercise price of CDN$4.21; Black-Scholes valuation factor = CDN$2.8147 - converted into US$ at a rate of US$1.00 = CDN$1.3141. |

(13) | Calculation based on 110,000 options at an exercise price of CDN$4.21; Black-Scholes valuation factor = CDN$2.8147 - converted into US$ at a rate of US$1.00 = CDN$1.3141. |

(14) | Calculation based on 90,000 options at an exercise price of CDN$4.21; Black-Scholes valuation factor = CDN$2.8147 - converted into US$ at a rate of US$1.00 = CDN$1.3141. |

(15) | Calculation based on 40,000 options at an exercise price of CDN$3.91; Black-Scholes valuation factor = CDN$2.3824 - converted into US$ at a rate of US$1.00 = CDN$1.2965. |

(16) | Represents the one-time bonus of $50,000 paid to Dr. Glickman upon entering into his employment agreement, plus the 2017 earned bonus of $346,568. |

(17) | The total amount of other annual compensation including perquisites for the remaining NEO’s on an aggregate basis, generally including group insurance benefits, does not exceed the lesser of $50,000 and 10% of their annual cash compensation. |

(18) | Represents fees of $88,419 and option-based awards of $14,801 earned as a Chairman of the Board. |

(a) | In the event that Dr. Glickman’s employment is terminated by the Company without cause after the first year of his employment, he is entitled to receive a payment in lieu of notice equivalent to 12 months of his then current base salary, plus one additional month’s base salary for each full year of employment beyond the first 12 months of employment, up to a maximum of 18 months. If some or all bonus objectives have been satisfied prior to his last day of work for the Company, he will be entitled to a performance bonus pursuant to the performance bonus section of the employment agreement for the year of termination, with the amount to be determined based on the objectives satisfied. In addition, the Company is to maintain health and medical benefits pursuant to the benefits section of |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(b) | In the event that Dr. Glickman’s employment is terminated by the Company without cause or by the executive for "good reason" within 12 months following a change in control of the Company, Dr. Glickman is entitled to receive a lump sum payment in lieu of notice equal to 18 months of his then current base salary, and if awarded and payable, the bonus for that year. In addition, the Company is to maintain health and medical benefits pursuant to the benefits section of the employment agreement during the 12-month period following the termination date. All of Dr. Glickman’s unexercised stock options will immediately vest upon the termination of his employment and shall be fully exercisable in accordance with the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

(c) | On April 29, 2019, Dr. Richard Glickman, who previously announced his plans to retire on November 6, 2018, resigned from his position as an officer and director of the Company. The Company entered into a Retirement Transition Agreement with him (the "Retirement Agreement") whereby Dr. Glickman agreed to remain as an advisor to the Company’s new CEO for a period of 12 months from the date he ceased his duties as CEO. Pursuant to the Retirement Agreement, Dr. Glickman is entitled to receive the cash bonus he would have been eligible to receive pursuant to his employment agreement had he not retired, such bonus to be pro-rated to May 6, 2019. In addition, any stock options that remain unvested as at May 6, 2019 will vest equally on the last day of each month (over 12 months) during which Dr. Glickman has made himself reasonably available to the Company’s new CEO. All Dr. Glickman's vested options will be permitted to be exercised for a period of 15 months following May 6, 2019. Pursuant to the Retirement Agreement, Dr. Glickman continues to be bound by the non-competition, non-solicitation, non-disclosure and assignment of intellectual property provisions of the employment agreement, with the exception that the restrictive covenants have been extended from six months to 12 months from May 6, 2019. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(a) | In the event that Dr. Solomons’ employment is terminated by the Company without cause, he will be entitled to receive a payment in lieu of notice equivalent to 12 months of his then current base salary, plus one additional month’s base salary for each full year of employment, up to a maximum of 18 months in the aggregate, plus such other sums, if granted, pursuant to the performance bonus section of the employment agreement. In addition, the Company is to maintain the benefits pursuant to the benefits section of the employment agreement for the duration of the notice period. All of Dr. Solomons’ unexercised vested options would be exercisable over a period of 90 days pursuant to the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

(b) | In the event that Dr. Solomons’ employment is terminated by the Company without cause or by the executive for "good reason" within 12 months following a change in control of the Company, Dr. Solomons is entitled to receive a lump sum payment in lieu of notice equal to 150% of 12 months of his then current base salary, plus such other sums, if granted, pursuant to the performance bonus section of the employment agreement. In addition, the Company is to maintain the benefits pursuant to the benefits section of the employment agreement during the 12-month period. All of Dr. Solomons’ unexercised stock options would fully vest and would be exercisable over a period of 90 days pursuant to the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

(a) | In the event that Mr. Martin’s employment is terminated by the Company without cause, he will be entitled to receive a payment in lieu of notice equivalent to 12 months of his then current base salary, plus one additional month’s base salary for each full year of employment, up to a maximum of 18 months in the aggregate, plus such other sums, if granted, pursuant to the performance bonus section of the employment agreement. In addition, the Company is to maintain the benefits pursuant to the benefits section of the employment agreement for the duration of the notice period. All of Mr. Martin’s unexercised vested options would be exercisable over a period of 90 days pursuant to the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(b) | In the event that Mr. Martin’s employment is terminated by the Company without cause or by the executive for "good reason" within 12 months following a change in control of the Company, Mr. Martin is entitled to receive a lump sum payment in lieu of notice equal to 150% of 12 months of his then current base salary, plus such other sums, if granted, pursuant to the performance bonus section of the employment agreement. In addition, the Company is to maintain the benefits pursuant to the benefits section of the employment agreement during the 12-month period. All of Mr. Martin’s unexercised stock options would fully vest and would be exercisable over a period of 90 days pursuant to the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(a) | In the event that Mr. Bourgeault’s employment is terminated by the Company without cause or by the executive for "good reason", Mr. Bourgeault is entitled to receive a cash payment in lieu of notice equivalent to 18 months of his annualized base salary then in effect, plus such other sums, if granted, pursuant to the performance bonus section of the employment agreement. All of Mr. Bourgeault’s unexercised vested options would be exercisable over a period of 90 days pursuant to the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

(b) | In the event that Mr. Bourgeault’s employment is terminated by the Company without cause or by the executive for "good reason" within 12 months following a change in control of the Company, Mr. Bourgeault is entitled to receive a lump sum payment in lieu of notice equal to 150% of 12 months of his annualized base salary then in effect, plus such other sums, if granted, pursuant to the performance bonus section of the employment agreement. In addition, the Company is to maintain the benefits pursuant to the benefits section of the employment agreement during the 12-month period. All of Mr. Bourgeault’s unexercised stock options would fully vest and would be exercisable over a period of 90 days pursuant to the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(c) | In the event that Dr. Huizinga’s employment is terminated by the Company without cause or by the executive for "good reason", Dr. Huizinga is entitled to receive a cash payment in lieu of notice equivalent to 18 months of his annualized base salary then in effect, plus such other sums, if granted, pursuant to the performance bonus section of the employment agreement. All of Dr. Huizinga’s unexercised vested options would be exercisable over a period of 90 days pursuant to the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

(d) | In the event that Dr. Huizinga’s employment is terminated by the Company without cause or by the executive for "good reason" within 12 months following a change in control of the Company, Dr. Huizinga is entitled to receive a lump sum payment in lieu of notice equal to 150% of 12 months of his annualized base salary then in effect, plus such other sums, if granted, pursuant to the performance bonus section of the employment agreement. In addition, the Company is to maintain the benefits pursuant to the benefits section of the employment agreement during the 12-month period. All of Dr. Huizinga’s unexercised stock options would fully vest and would be exercisable over a period of 90 days pursuant to the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

(e) | In the event that Mr. Greenleaf’s employment is terminated by the Company without cause, he is entitled to receive continuing payments of severance pay for a period of 12 months, plus one additional month for each full year of employment, up to a maximum of 18 months in the aggregate, equal to his then current base salary, plus such other sums, if granted, pursuant to the performance bonus section of the employment agreement. In addition, to the extent permitted by law and subject to the terms and conditions of any benefit plans in effect from time to time, the Company is to maintain health and medical benefits pursuant to the benefits section of the employment agreement for the duration of the severance period. Any options forming part of the initial option |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(f) | In the event that Mr. Greenleaf’s employment is terminated by the Company without cause or by the executive for "good reason" within 12 months following a change in control of the Company, Mr. Greenleaf is entitled to receive a lump sum payment equal to 18 months of his then current base salary, and if awarded and payable, the target bonus for the year of termination. In addition, the Company is to maintain health and medical benefits pursuant to the benefits section of the employment agreement during the 12-month period following the termination date. All of Mr. Greenleaf’s unexercised stock options will immediately vest upon the termination of his employment and shall be fully exercisable in accordance with the terms and conditions under which the stock options were granted, subject to the prior expiry of his stock options in accordance with their terms. |

Termination Without Cause | Termination Following Change in Control | |||||

Severance ($) | Accelerated Vesting of Options(9) ($) | Continuation of Benefits ($) | Severance ($) | Accelerated Vesting of Options(9) ($) | Continuation of Benefits ($) | |

Dr. Richard Glickman | 925,132(1) | Nil | 7,275 | 1,138,924(2) | 1,743,741 | 6,715 |

Mr. Dennis Bourgeault | 496,063(3) | Nil | Nil | 496,063(3) | 472,084 | 6,741 |

Dr. Neil Solomons | 668,3034) | Nil | 6,584 | 695,043(5) | 475,370 | 4,648 |

Dr. Robert Huizinga | 640,766(6) | Nil | Nil | 640,766(6) | 487,727 | 5,414 |

Mr. Michael Martin | 454,130(7) | Nil | 7,670 | 473,983(8) | 349,237 | 5,414 |

(1) | Severance amount is comprised of 13 months' salary in the sum of $555,858, plus accrued bonus of $343,000 and accrued vacation pay of $26,274. The bonus was paid out in the first quarter of 2019. |

(2) | Severance amount is comprised of 18 months’ salary in the sum of $769,650 plus accrued bonus of $343,000 and accrued vacation pay of $26,274. The bonus was paid out in the first quarter of 2019. |

(3) | Severance amount is comprised of 18 months’ salary in the sum of $343,595 plus accrued bonus of $86,220 and accrued vacation pay of $66,248. The bonus was paid out in the first quarter of 2019. |

(4) | Severance amount is comprised of 17 months’ salary in the sum of $454,567 plus accrued bonus of $130,856 and accrued vacation pay of $82,880. The bonus was paid out in the first quarter of 2019. |

(5) | Severance amount is comprised of 18 months’ salary in the sum of $481,307 plus accrued bonus of $130,856 and accrued vacation pay of $82,880. The bonus was paid out in the first quarter of 2019. |

(6) | Severance amount is comprised of 18 months’ salary in the sum of $452,994 plus accrued bonus of $115,935 and accrued vacation pay of $71,837. The bonus was paid out in the first quarter of 2019. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(7) | Severance amount is comprised of 17 months’ salary in the sum of $337,485 plus accrued bonus of $97,882 and accrued vacation pay of $18,763. The bonus was paid out in the first quarter of 2019. |

(8) | Severance amount is comprised of 18 months’ salary in the sum of $357,338 plus accrued bonus of $97,882 and accrued vacation pay of $18,763. The bonus was paid out in the first quarter of 2019. |

(9) | Represents the value of unvested in-the-money options that would vest upon termination of employment as at December 31, 2018. Closing share price on TSX on December 31, 2018 was CDN$9.28= US$6.80, converted to US$ at a rate of US$1.00 = CDN$1.3643. |

Option-based Awards | Share-based Awards | ||||||

Name | Number of securities underlying unexercised options (#) | Option exercise price(2) ($) | Option expiration date | Value of unexercised in-the-money options ($)(1) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested ($) | Market or payout value of vested share-based awards not paid out or distributed ($) |

Dr. Richard Glickman | 400,000 | 5.19 | February 5, 2028 | 838,552 | Nil | Nil | Nil |

1,050,000 | 3.20 | February 9, 2027 | 3,902,126 | Nil | Nil | Nil | |

200,000 | 3.19 | February 18, 2024 | 847,348 | Nil | Nil | Nil | |

10,000 | 3.08 | March 23, 2021 | 38,996 | Nil | Nil | Nil | |

10,000 | 3.59 | January 6, 2020 | 36,870 | Nil | Nil | Nil | |

Mr. Dennis Bourgeault | 150,000 | 5.30 | February 1, 2028 | 303,462 | Nil | Nil | Nil |

175,000 | 3.20 | February 9, 2027 | 650,354 | Nil | Nil | Nil | |

40,000 | 3.02 | March 30, 2021 | 157,448 | Nil | Nil | Nil | |

93,337 | 3.40 | August 17, 2020 | 330,449 | Nil | Nil | Nil | |

137,439 | 3.59 | January 6, 2020 | 506,736 | Nil | Nil | Nil | |

Dr. Neil Solomons | 175,000 | 5.30 | February 1, 2028 | 354,039 | Nil | Nil | Nil |

152,000 | 3.20 | February 9, 2027 | 564,879 | Nil | Nil | Nil | |

40,000 | 3.02 | March 30, 2021 | 157,448 | Nil | Nil | Nil | |

147,439 | 3.59 | January 6, 2020 | 543,606 | Nil | Nil | Nil | |

Mr. Michael Martin | 150,000 | 5.30 | February 1, 2028 | 303,462 | Nil | Nil | Nil |

90,000 | 3.20 | February 9, 2027 | 334,468 | Nil | Nil | Nil | |

40,000 | 3.02 | March 30, 2021 | 157,448 | Nil | Nil | Nil | |

147,439 | 3.59 | January 6, 2020 | 543,606 | Nil | Nil | Nil | |

Dr. Robert Huizinga | 225,000 | 5.30 | February 1, 2028 | 455,193 | Nil | Nil | Nil |

110,000 | 3.20 | February 9, 2027 | 408,794 | Nil | Nil | Nil | |

16,000 | 3.45 | December 11, 2022 | 67,788 | Nil | Nil | Nil | |

40,000 | 3.02 | March 30, 2021 | 157,448 | Nil | Nil | Nil | |

31,529 | 3.40 | August 17, 2020 | 111,625 | Nil | Nil | Nil | |

100,008 | 3.59 | January 6, 2020 | 368,728 | Nil | Nil | Nil | |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

(1) | Closing share price on TSX on December 31, 2018 was CDN$9.28; closing price on the NASDAQ on December 31, 2018 was US$6.82. The value of unexercised in-the-money options was determined using the TSX closing price multiplied by the number of options converted to US dollars at a rate of US$1.00 = CDN$1.3643. |

(2) | Option exercise price was determined based on the Canadian dollar exercise price at the time of the grant converted into US$ using the Bank of Canada closing rate on the date of granting of the options. |

Name | Option-based Awards | Share-based awards - Value vested during the year ($) | Non-equity incentive plan compensation - Value earned during the year ($) | |

Number of Securities Underlying Options Vested (#) | Value vested during the year(1) ($) | |||

Dr. Richard Glickman | 373,611 | 661,079 | Nil | Nil |

Mr. Dennis Bourgeault | 100,000 | 156,067 | Nil | Nil |

Dr. Neil Solomons | 99,278 | 143,580 | Nil | Nil |

Dr. Robert Huizinga | 99,166 | 121,551 | Nil | Nil |

Mr. Michael Martin | 71,667 | 93,336 | Nil | Nil |

(1) | The value reflected in the above chart relates to the in-the-money value of options at the date of the vesting and has been converted into US$ using the Bank of Canada closing rate on the date of granting of the options. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Name | Earned Fees ($) | Share- based awards ($) | Option- based awards(1) ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation ($) | Total ($) |

Mr. Jeff Randall | 85,000 | Nil | 68,616(2) | Nil | Nil | Nil | 153,616 |

Dr. Benjamin Rovinski | 62,500 | Nil | 68,616(2) | Nil | Nil | Nil | 131,116 |

Dr. Joon Lee | 65,500 | Nil | 68,616(2) | Nil | Nil | Nil | 134,116 |

Dr. David Jayne | 52,500 | Nil | 68,616(2) | Nil | Nil | Nil | 121,616 |

Dr. George M. Milne, Jr. | 58,000 | Nil | 68,616(2) | Nil | Nil | Nil | 126,616 |

Mr. Joseph Hagan | 53,000 | Nil | 112,096(3) | Nil | Nil | Nil | 165,096 |

Dr. Michael Hayden | 55,000 | Nil | 120,412(4) | Nil | Nil | Nil | 175,412 |

(1) | Calculated as of the grant date using the Black-Scholes option pricing model. The value shown is calculated by multiplying the number of stock options granted by the Canadian dollar exercise price at the time of grant by the Black-Scholes valuation factor and converting the value into US$ using the Bank of Canada closing rate on the date of granting of the options. The value is the same as the accounting fair value of the full grant but is not adjusted by the vesting schedule. |

(2) | Calculation based on 30,000 options at an exercise price of CDN$6.42; Black-Scholes valuation factor = CDN$2.8314 – converted into US$ at a rate of US$1.00 = CDN$1.2379. |

(3) | Calculation based on 50,000 options at an exercise price of CDN$6.40; Black-Scholes valuation factor = CDN$2.8214 – converted into US$ at a rate of US$1.00 = CDN$1.2585. |

(4) | Calculation based on 50,000 options at an exercise price of CDN$6.92; Black-Scholes valuation factor = CDN$3.0515 – converted into US$ at a rate of US$1.00 = CDN$1.2671. |

• | Compensation Committee Chair Retainer: $15,000 |

• | Audit Committee Chair Retainer: $15,000 |

• | Governance Committee Chair Retainer: $10,000 |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

• | Research Committee Chair Retainer: $15,000 |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Option-based Awards | Share-based Awards | ||||||

Name | Number of securities underlying unexercised options (#) | Option exercise price(2) ($) | Option expiration date | Value of unexercised in-the-money options(1) ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested ($) | Market or payout value of vested share-based awards not paid out or distributed ($) |

Dr. Benjamin Rovinski | 30,000 | 5.19 | February 5, 2028 | 62,891 | Nil | Nil | Nil |

20,000 | 6.95 | April 26, 2027 | Nil | Nil | Nil | Nil | |

10,000 | 3.62 | February 16, 2027 | 33,352 | Nil | Nil | Nil | |

10,000 | 3.00 | March 23, 2021 | 38,996 | Nil | Nil | Nil | |

10,000 | 3.59 | January 6, 2020 | 36,870 | Nil | Nil | Nil | |

20,000 | 3.19 | February 18, 2024 | 84,735 | Nil | Nil | Nil | |

Dr. David Jayne | 30,000 | 5.19 | February 5, 2028 | 62,891 | Nil | Nil | Nil |

20,000 | 6.95 | April 26, 2027 | Nil | Nil | Nil | Nil | |

10,000 | 3.62 | February 16, 2027 | 33,352 | Nil | Nil | Nil | |

10,000 | 3.00 | March 23, 2021 | 38,996 | Nil | Nil | Nil | |

20,000 | 3.47 | June 2, 2020 | 72,860 | Nil | Nil | Nil | |

Mr. Jeff Randall | 30,000 | 5.19 | February 5, 2028 | 62,891 | Nil | Nil | Nil |

20,000 | 6.95 | April 26, 2027 | Nil | Nil | Nil | Nil | |

10,000 | 3.62 | February 16, 2027 | 33,352 | Nil | Nil | Nil | |

10,000 | 2.74 | January 20, 2027 | 41,268 | Nil | Nil | Nil | |

10,000 | 2.78 | December 14, 2026 | 41,268 | Nil | Nil | Nil | |

Dr. Joon Lee | 30,000 | 5.19 | February 5, 2028 | 62,891 | Nil | Nil | Nil |

20,000 | 6.95 | April 26, 2027 | Nil | Nil | Nil | Nil | |

10,000 | 3.62 | February 16, 2027 | 33,352 | Nil | Nil | Nil | |

10,000 | 3.00 | March 23, 2021 | 38,996 | Nil | Nil | Nil | |

20,000 | 3.47 | June 2, 2020 | 72,860 | Nil | Nil | Nil | |

Dr. George M. Milne, Jr. | 30,000 | 5.19 | February 5, 2028 | 62,891 | Nil | Nil | Nil |

50,000 | 6.40 | June 23, 2027 | 29,320 | Nil | Nil | Nil | |

Mr. Joseph Hagan | 50,000 | 5.09 | February 9, 2028 | 105,552 | Nil | Nil | Nil |

Dr. Michael Hayden | 50,000 | 5.46 | February 22, 2028 | 86,494 | Nil | Nil | Nil |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Name | Option-based Awards | Share-based awards - Value vested during the year ($) | Non-equity incentive plan compensation - Value earned during the year ($) | |

Number of Securities Underlying Options Vested(1) (#) | Value vested during the year(2) ($) | |||

Mr. Jeff Randall | 34,167 | 22,435 | Nil | Nil |

Dr. Benjamin Rovinski | 33,334 | 20,358 | Nil | Nil |

Dr. David Jayne | 33,334 | 20,358 | Nil | Nil |

Dr. Joon Lee | 33,334 | 20,358 | Nil | Nil |

Dr. George M. Milne, Jr. | 50,000 | 17,974 | Nil | Nil |

Mr. Joseph Hagan | 41,667 | 28,771 | Nil | Nil |

Dr. Michael Hayden | 41,667 | 10,326 | Nil | Nil |

(1) | The value reflected in the above chart relates to the in-the-money value of options at the date of the vesting. |

(2) | The value vested during the year has been converted into US$ using the Bank of Canada closing rate on the date of granting of the options. |

• | Administration. The Stock Option Plan is administered by the Board (or a committee thereof) which has the power to (i) grant options, (ii) reserve Common Shares for issuance upon the exercise of options, (iii) determine the terms, limitations, restrictions and conditions respecting option grants, (iv) interpret the Stock Option Plan and adopt, amend and rescind such administrative guidelines and other rules and regulations relating to the Stock Option Plan , and (v) make all other determinations and take all other actions in connection with the implementation and administration of the Stock Option Plan. |

• | Number of Securities Issuable. The Stock Option Plan is a rolling stock option plan that reserves, for issuance pursuant to stock options, a maximum number of Common Shares equal to 12.5% of the outstanding Common Shares of the Company at the time the Common Shares are reserved for issuance. As at May 9, 2019, an aggregate of 8,184,969 Common Shares (or 8.92% of the total number of issued and outstanding Common Shares) are issuable under the Stock Option Plan pursuant to outstanding options leaving a total of 3,277,901 Common Shares (or 3.57% of the total number of issued and outstanding Common Shares) issuable under the Stock Option Plan. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

• | Eligible Persons. "Service Providers" are eligible to receive grants of options under the Stock Option Plan. "Service Providers" is defined as bona fide directors, officers, employees, management company employees and consultants and also includes a company of which 100% of the share capital is beneficially owned by one or more individual Service Providers. |

• | Shareholder Approval. The unallocated entitlements under the Stock Option Plan must be approved by the Shareholders every three years. The Shareholders last re-approved the unallocated entitlements under the Stock Option Plan on June 21, 2017. |

• | Grants to One Person. The number of Common Shares reserved for issue to any one person under the Stock Option Plan may not exceed 5% of the outstanding Common Shares at the time of grant. |

• | Insiders. Without the prior approval of the Shareholders, the number of Common Shares being issuable to insiders under the Stock Option Plan at any time, when combined with all of the Company’s other share compensation arrangements, shall not exceed 10% of the issued and outstanding Common Shares, and the number of Common Shares issued to insiders under the Stock Option Plan, when combined with all of the Company’s other share compensation arrangements, shall not exceed 10% of the issued and outstanding Common Shares in any 12 month period. |

• | Exercise Price. The exercise price of options under the Stock Option Plan will be set by the Board at the time of grant and cannot be less than the Market Price (defined in the Stock Option Plan as the closing trading price for the Common Shares on the TSX on the day immediately prior to the date of grant). |

• | Vesting. Vesting of options is at the discretion of the Board. Options become exercisable only after they vest in accordance with the respective commitment and exercise form. |

• | Term of Options. Options granted under the Stock Option Plan will have a maximum term of ten years from their date of grant. |

• | No Assignment. All options will be exercisable only by the optionee to whom they are granted and are non-assignable and non-transferable. |

• | Termination of Exercise Right. No option may be exercised after an optionee has left the employ or service of the Company except as follows: |

◦ | in the event of an optionee’s death, any vested option held by the optionee at the date of death will be exercisable by the optionee’s lawful personal representatives, heirs or executors until the earlier of 12 months after the date of death and the date of expiration of the term otherwise applicable to such option; |

◦ | in the event of an optionee’s disability, any vested option held by the optionee will be exercisable until the earlier of 12 months after the date the Board makes a determination of disability and the date of expiration of the term otherwise applicable to such option; |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

◦ | generally speaking, vested options will expire 90 days after the date the optionee ceases to be employed by, provide services to, or be a Director or Officer of, the Company, and any unvested options shall immediately terminate. |

• | Change in Control. Upon a change in control or takeover bid, vesting can be accelerated in accordance with the provisions set out in the Stock Option Plan. |

• | Extension of Expiry Period. If an option which has been previously granted is set to expire during a period in which trading in securities of the Company by the option holder is restricted by a black-out, or within nine business days of the expiry of a black-out, the expiry date of the option will be extended to ten business days after the trading restrictions are lifted. |

• | Amendments Requiring Shareholder Approval. Shareholder approval is required for the following amendments to the Stock Option Plan: |

◦ | an increase to the aggregate percentage of securities issuable under the Stock Option Plan; |

◦ | a reduction in the exercise price of an outstanding option; |

◦ | an extension of the term of any option beyond the expiry date; |

◦ | any amendment to permit assignments or exercises other than by the optionee other than as set out in the Stock Option Plan; |

◦ | amendment to the individuals eligible to receive options under the Stock Option Plan; |

◦ | an amendment to the Stock Option Plan to provide for other types of compensation through equity issuance, other than an amendment in the nature of a substitution and/or adjustment made by the Board in response to a change to, event affecting, exchange of, or corporate change or transaction affecting the Common Shares; and |

◦ | an amendment which is required to be approved by Shareholders under applicable law (including, without limitation, applicable TSX policies). |

• | Amendments Without Shareholder Approval. Subject to the policies of the TSX, the Stock Option Plan may be amended without Shareholder approval for the following: |

◦ | amendments of a "housekeeping" nature; |

◦ | amendments necessary to comply with the provisions of applicable law; |

◦ | amendments respecting the administration of the Stock Option Plan; |

◦ | any amendment to the vesting provisions of the Stock Option Plan or any option; |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

◦ | any amendment to the early termination provisions of the Stock Option Plan or any option, whether or not such option is held by an insider, provided such amendment does not entail an extension beyond the original expiry date; |

◦ | any amendments necessary to suspend or terminate the Stock Option Plan; and |

◦ | any other amendment not requiring Shareholder approval under applicable law (including, without limitation, applicable TSX policies). |

(as at December 31) | 2018 | 2017 | 2016 |

Number of options granted under the Stock Option Plan | 3,003,000 | 2,728,500 | 1,470,000 |

Weighted average number of securities outstanding | 84,782,436 | 76,918,394 | 35,285,288 |

Burn Rate (%) | 3.54% | 3.55% | 4.17% |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Plan Category | Number of common shares to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of Common Shares remaining available for future issuance under the equity compensation plans (excluding securities reflected in the first column)(1) |

Equity Compensation plans approved by security holders Stock Option Plan | 7,426,826 | 4.07(2) | 3,260,702 |

Equity compensation plans not approved by security holders Option Commitment | 163,601(3) | 2.68(4) | n/a |

Total: | 7,590,427 | 4.04 | 3,260,702 |

(1) | Under the Stock Option Plan, any increase in the number of outstanding Common Shares will result in an increase in the number of Common Shares that are available to be issued under the plan in the future, and any exercise of an option previously granted under the Stock Option Plan will result in an additional option being available for grant under the Stock Option Plan. |

(2) | Weighted-average exercise price of CDN$5.55 converted into US$ at the Bank of Canada closing rate on December 31, 2018 of US$1.00 = CDN$1.3643. |

(3) | 200,000 options to acquire Common Shares were issued under an option commitment to Bradley J. Dickerson on May 2, 2016 under section 613(c) of the TSX Company Manual which allows the Company to issue security based compensation without shareholder approval as an inducement to employment to a person not previously employed by the Company to enter into full time employment with the Company. Mr. Dickerson’s options vest according to a vesting schedule specified in the option commitment, becoming fully vested on the third year anniversary of the grant date, for so long as he remains employed by the Company, and may be exercised up to five years from the grant date at an exercise price of CDN$3.66 per Common Share. As at December 31, 2018, 163,601 options remain outstanding. On April 29, 2019, the Company issued an additional 1,600,000 options to purchase Common Shares under an option commitment to Peter Greenleaf under section 613(c) of the TSX Company Manual. Mr. Greenleaf’s options vest according to a vesting schedule specified in the option commitment, becoming fully vested on the fourth year anniversary of the grant date, for so long as he remains employed by the Company, and may be exercised up to ten years from the grant date at an exercise price of CDN$8.45 per Common Share. As these options were issued after December 31, 2018, they are not included in the above table. While options issued under option commitments are not issued pursuant to the Stock Option Plan, to the extent not otherwise specified in the relevant option commitment, the options will be governed by like terms and conditions as set out in the Stock Option Plan, and such terms are specifically incorporated into the option commitments. |

(4) | Exercise price of CDN$3.66 converted into US$ at the Bank of Canada closing rate on December 31, 2018 of US$1.00 = CDN$1.3643. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

• | the assumption that we will be able to obtain approval from regulatory agencies on executable development programs with parameters that are satisfactory to us; |

• | the assumption that we will successfully complete our clinical programs on a timely basis, including conducting the required AURORA clinical trial and meet regulatory requirements for approval of marketing authorization applications and new drug approvals, as well as favourable product labeling; |

• | the assumption that the planned studies will achieve positive results; |

• | the assumptions regarding the costs and expenses associated with the Company’s clinical trials; |

• | the assumption the regulatory requirements and commitments will be maintained; |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

• | the assumption that we will be able to meet good manufacturing practices standards and manufacture and secure a sufficient supply of voclosporin on a timely basis to successfully complete the development and commercialization of voclosporin; |

• | the assumptions on the market value for the lupus nephritis program; |

• | the assumption that the Company’s patent portfolio is sufficient and valid; |

• | the assumption that the United States Patent and Trademark Office will issue a new patent for its dosing protocol once applicable steps have been followed and fees paid; |

• | the assumption that the Company will be able to extend its patents to the fullest extent allowed by law, on terms most beneficial to us; |

• | the assumptions on the market; |

• | the assumption that the Company’s current good relationships with its suppliers, service providers and other third parties will be maintained; |

• | the assumption that we will be able to attract and retain a sufficient amount of skilled staff; and/or |

• | actual results could be materially different from what the Company expect if known or unknown risks affect its business, or if its estimates or assumptions turn out to be inaccurate. As a result, the Company cannot guarantee that any forward-looking statement will materialize and, accordingly, you are cautioned not to place undue reliance on these forward-looking statements; |

• | forward-looking statements do not take into account the effect that transactions or non-recurring or other special items announced or occurring after the statements are made may have on the Company’s business. For example, they do not include the effect of mergers, acquisitions, other business combinations or transactions, dispositions, sales of assets, asset write-downs or other charges, and do not include the effect of activities by shareholder activists, including a proxy contest or any unsolicited takeover proposal, announced or occurring after the forward-looking statements are made. The financial impact of such transactions and non-recurring and other special items can be complex and necessarily depend on the facts particular to each of them. Accordingly, the expected impact cannot be meaningfully described in the abstract or presented in the same manner as known risks affecting the Company’s business. |

• | the need for additional capital in the future to continue to fund the Company’s development programs and commercialization activities, and the effect of capital market conditions and other factors on capital availability; |

• | difficulties, delays, or failures we may experience in the conduct of and reporting of results of the Company’s clinical trials for voclosporin; |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

• | difficulties in meeting good manufacturing practices standards and the manufacturing and securing of a sufficient supply of voclosporin on a timely basis to successfully complete the development and commercialization of voclosporin; |

• | difficulties in gaining alignment among the key regulatory jurisdictions, European Medicines Agency, Food and Drug Administration of the United States Government and Pharmaceutical and Medical Devices Agency, which may require further clinical activities; |

• | difficulties, delays or failures in obtaining regulatory approvals to market voclosporin; |

• | not being able to extend the Company’s patent portfolio for voclosporin; |

• | the Company’s patent portfolio not covering all of its proposed uses of voclosporin; |

• | difficulties we may experience in completing the development and commercialization of voclosporin; |

• | the market for the lupus nephritis business may not be as we have estimated; |

• | difficulties obtaining adequate reimbursements from third party payors; |

• | difficulties obtaining formulary acceptance; |

• | product liability, patent infringement and other civil litigation; and |

• | injunctions, court orders, regulatory and other enforcement actions. |

/s/ Dr. George M. Milne, Jr. | /s/ Peter Greenleaf | |

Director and Chairman of the Board | Director and Chief Executive Officer | |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Corporate Governance Disclosure Requirements | The Company’s Governance Procedures | |

1. Board of Directors – Disclose how the board of directors (the "Board") facilitates its exercise of independent supervision over management, including: | The Board has reviewed the independence of each director of the Board ("Director") as defined in NI 58-101. A Director who is independent has no direct or indirect material relationship with the Company, including a relationship which in the view of the Board could reasonably interfere with the Director’s exercise of independent judgment. After having reviewed the role and relationships of each Director, the Board has determined that the following Directors nominated by management for election to the Board are independent, namely: Dr. George M. Milne, Jr. Dr. David R.W. Jayne Mr. Lorin J. Randall Dr. Hyuek Joon Lee Mr. Joseph P. Hagan Dr. Michael Hayden Mr. R. Hector MacKay-Dunn | |

(a) the identity of directors that are independent. | ||

(b) the identity of directors who are not independent, and the basis for that determination. | Mr. Peter Greenleaf | Peter Greenleaf is considered to have a material relationship with the Company by virtue of being the CEO of the Company. |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Corporate Governance Disclosure Requirements | The Company’s Governance Procedures | |

Dr. Daniel G. Billen | Daniel G. Billen is considered to have a material relationship with the Company by virtue of having been a recent consultant to the Company. | |

(c) whether or not a majority of the directors are independent. If a majority of directors are not independent, describe what the Board does to facilitate its exercise of independent judgment in carrying out its responsibilities. | A majority of the Board is independent. | |

(d) If a director is presently a director of any other issuer that is a reporting issuer (or the equivalent) in a jurisdiction or a foreign jurisdiction, identify both the director and the other issuer. | This information is disclosed in the Circular in Section 2.1.3. | |

(e) Disclose whether or not the independent directors hold regularly scheduled meetings at which non-independent directors and members of management are not in attendance. If the independent directors hold such meetings, disclose the number of meetings held since the beginning of the issuer’s most recently completed financial year. If the independent directors do not hold such meetings, describe what the board does to facilitate open and candid discussion among its independent directors. | The independent Directors hold an independent Directors meeting a week prior to each scheduled Board meeting and hold in camera meetings following every meeting of the Board. | |

(f) Disclose whether or not the chair of the board is an independent director. If the board has a chair or lead director who is an independent director, disclose the identity of the independent chair or lead director, and describe his or her role and responsibilities. If the board has neither a chair that is independent nor a lead director that is independent, describe what the board does to provide leadership for its independent directors. | Dr. Richard Glickman was the Chairman of the Board until April 29, 2019. Dr. Glickman was not an independent Director. The Chairman’s primary responsibility is managing the affairs of the Board including ensuring the Board is organized properly, functions effectively, and meets it obligations and responsibilities as set out in the by-laws of the Company and its mandate. The Chairman works to ensure effective relations with the Board, shareholders, other stakeholders and the public. On June 21, 2017, the Board appointed Mr. Jeff Randall, an independent director, as the Lead Director. The Lead Director’s role was to ensure that the Board functions independent of management and to act as principal liaison between the independent directors and the CEO. The responsibilities of the Lead Director included presiding over meetings of independent directors, reviewing and making recommendations with respect to the agendas, and providing the leadership necessary to provide greater assurance that the Board operates and functions independent of management and that Board | |

YOUR VOTE IS IMPORTANT - SUBMIT YOUR YELLOW PROXY TODAY. FOR ASSISTANCE VOTING YOUR YELLOW PROXY, PLEASE CONTACT LAUREL HILL ADVISORY GROUP AT: 1-877-452-7184 TOLL FREE (1-416-304-0211 COLLECT), OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM |

Corporate Governance Disclosure Requirements | The Company’s Governance Procedures | |

functions are effectively carried out. However, upon the appointment of Dr. George Milne, an independent Director, as the Chairman of the Board on April 29, 2019, there is no longer a requirement for a Lead Director. | ||

(g) Disclose the attendance record of each director for all board meetings held since the beginning of the issuer’s most recently completed financial year. | This information is disclosed in the Circular in Section 2.1.2. | |

2. Board Mandate – Disclose the text of the board’s written mandate. If the board does not have a written mandate, describe how the board delineates its role and responsibilities. | A copy of the mandate of the Board is attached to this Circular as Appendix "B". | |