UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

__________________________________________________

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

AURINIA PHARMACEUTICALS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| | |

| (5) | Total fee paid: |

| | |

| | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| | |

| (3) | Filing Party: |

| | |

| | |

| (4) | Date Filed: |

| | |

AURINIA PHARMACEUTICALS INC.

#1203 - 4464 Markham Street, Victoria, BC V8Z 7X8 Canada

April 15, 2022

Dear Valued Shareholder,

You are cordially invited to attend the annual general meeting (the "Meeting") of shareholders of Aurinia Pharmaceuticals Inc. (the “Company”) to be held on May 17, 2022 at 12:00 p.m., Eastern Time. Due to the public health impact of the COVID 19 pandemic and to support the health and well-being of our shareholders, employees, management and directors, the Meeting will be a completely virtual meeting of shareholders. You can attend the Meeting by visiting https://web.lumiagm.com/435513610 (password (case sensitive): aurinia2022). Registered shareholders and their duly appointed proxyholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting.

At the Meeting, you will be asked to consider and vote on the proposals set forth in the enclosed management information circular and proxy statement relating to the Meeting. The Company’s board of directors unanimously recommends a vote “FOR” proposals 1, 2 and 3 as set forth in the management information circular and proxy statement.

Whether or not you plan to remotely attend the Meeting, it is important that your common shares be represented and voted at the Meeting. Accordingly, after reading the management information circular and proxy statement, please vote via the Internet, telephone or by mail by following the voting instructions included in the management information circular and proxy statement. If you hold your shares in “street name” through a broker, bank or other nominee, please vote in accordance with the instructions provided by such nominee.

The Company has fixed the close of business on April 14, 2022 as the record date for the determination of shareholders entitled to notice of, and to vote on the matters proposed at the Meeting and any adjournment or postponement thereof.

Thank you for your continued support.

| | | | | |

| Very truly yours, |

| |

| /s/ Peter Greenleaf |

| Peter Greenleaf |

| Director, President and Chief Executive Officer |

If you have any questions or require assistance voting, please contact our proxy solicitation agent, Laurel Hill Advisory Group toll free within North America at 1-877-452-7184 (1-416-304-0211 Outside North America), or by email at assistance@laurelhill.com.

AURINIA PHARMACEUTICALS INC.

#1203 - 4464 Markham Street

Victoria, BC V8Z 7X8 Canada

Notice of Annual General Meeting of Shareholders

To Be Held On May 17, 2022

Dear Shareholder:

NOTICE is hereby given that the Annual General Meeting (the “Meeting”) of shareholders of Aurinia Pharmaceuticals Inc. (the “Company”) will be held as a virtual-only meeting via live audio webcast online using the LUMI meeting platform at https://web.lumiagm.com/435513610 (password (case sensitive): aurinia2022) on Tuesday, May 17, 2022, at 12:00 PM, Eastern Time, for the following purposes:

1.to elect nine directors listed in the attached management information circular and proxy statement each to serve until the 2023 annual general meeting of shareholders or until their qualified successor has been duly elected or appointed;

2.to approve the appointment of PricewaterhouseCoopers LLP, Chartered Professional Accountants, as independent registered public accounting firm of the Company until the close of the 2023 annual general meeting of shareholders or until a successor is appointed;

3.to approve, on a non-binding advisory basis, a “say on pay” resolution regarding the Company’s executive compensation set forth in the attached management information circular and proxy statement; and

4.to transact such further and other business as may properly be brought before the Meeting or any adjournment or postponement thereof.

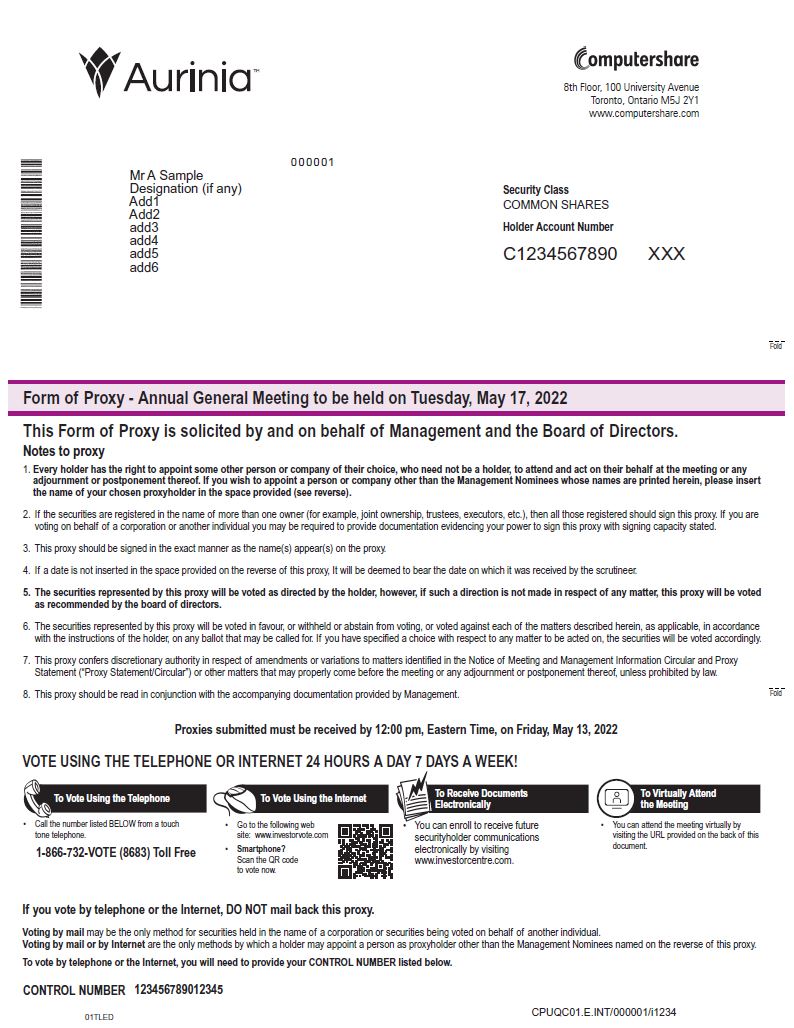

Management of the Company is soliciting proxies on the accompanying form of proxy (the “Proxy”). Whether or not you plan to attend the Meeting virtually, we encourage you to vote and submit your Proxy by telephone, via the Internet or by mail to avoid delays and ensure that as large a representation of shareholders as possible may be had at the Meeting. Specific details of the matters being put before the Meeting are set forth in more detail in the accompanying management information circular and proxy statement.

The Company's board of directors ("Board") has determined that only holders of record of the common shares of the Company at the close of business on April 14, 2022 will be entitled to vote in respect of the items set out in this notice of meeting at the Meeting. The Board has also determined 12:00 PM, Eastern Time, on May 13, 2022 or no later than 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment or postponement of the Meeting as the time before which proxies to be used or acted upon at the Meeting or any adjournment thereof must be deposited with the Company’s transfer agent. Failure to properly complete or deposit a Proxy may result in its invalidation.

DATED this 15th day of April, 2022.

| | | | | |

| By Order of the Board of Directors, |

| |

| /s/ Peter Greenleaf |

| Peter Greenleaf |

| Director, President and Chief Executive Officer |

| | |

You are cordially invited to attend the Meeting virtually. Whether or not you expect to attend the Meeting, please complete, date, sign and return the proxy that was mailed to you, or vote over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the Meeting. Please note, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Meeting (instead of doing so in advance), you must obtain a legal proxy issued in your name from the holder of record. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 17, 2022: We are delivering to all shareholders paper copies of all proxy materials. In addition, a complete set of proxy materials relating to the Meeting is available on the Internet. These materials, consisting of the Notice of Annual General Meeting of Shareholders and accompanying management information circular and proxy statement, our Annual Report on Form 10-K for the year ended December 31, 2021 and proxy card, are available under our profiles at www.sedar.com, www.edgar.gov, and our website, https://ir.auriniapharma.com/all-sec-filings.

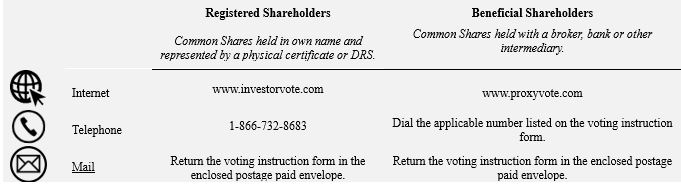

Voting is Easy. Vote Well in Advance of the Proxy Deadline on May 13, 2022 at 12:00 p.m. (ET)

Questions or Require Voting Assistance?

Contact our proxy solicitation agent, Laurel Hill Advisory Group toll free within North America at 1-877-452-7184 (1-416-304-0211 Outside North America), or by email at assistance@laurelhill.com.

TABLE OF CONTENTS

AURINIA PHARMACEUTICALS INC.

#1203 - 4464 Markham Street

Victoria, BC V8Z 7X8 Canada

MANAGEMENT INFORMATION CIRCULAR AND PROXY STATEMENT

FOR THE 2022 ANNUAL GENERAL MEETING OF SHAREHOLDERS

To be Held on May 17, 2022

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

What is the purpose of this Management Information Circular and Proxy Statement (the “Proxy Statement/Circular”)?

This Proxy Statement/Circular is being furnished because the Board of Directors (the “Board”) of Aurinia Pharmaceuticals Inc. (sometimes referred to as the “Company” or “Aurinia”) is soliciting your proxy to vote at the 2022 Annual General Meeting of shareholders, or at any adjournments or postponements thereof (the “Meeting”) to be held on Tuesday, May 17, 2022 at 12:00 p.m. Eastern Time. The Proxy Statement/Circular is first being mailed on or about April 21, 2022 to all shareholders of record entitled to vote at the Meeting.

Who do I contact if I have questions or need assistance in voting my shares?

Aurinia has retained Laurel Hill Advisory Group as its proxy solicitation agent. Shareholders can reach Laurel Hill toll free within North America at 1-877-452-7184 (1-416-304-0211 Outside North America), or by email at assistance@laurelhill.com.

How do I attend, participate in, and ask questions during the virtual Meeting online?

Due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our shareholders, employees, management and directors, this year’s Meeting will be our third time hosting a completely virtual meeting of shareholders, which will be conducted solely online via live audio webcast. Any shareholder can attend the virtual Meeting live online at https://web.lumiagm.com/435513610. The password for the meeting is aurinia2022 (case sensitive). There is no physical location for the Meeting. The meeting will start at 12:00 p.m. Eastern Time on Tuesday, May 17, 2022. We recommend that you log in at least 15 minutes before the scheduled start time on May 17, 2022 to ensure you are logged in when the Meeting begins. Registered shareholders and duly appointed proxyholders attending the virtual Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. To participate in the Meeting, you will need to review the information included in this Proxy Statement/Circular and on your proxy card.

You are entitled to participate in the Meeting only if you were a registered shareholder of the Company as of the close of business on April 14, 2022 (the "Record Date"), or if you hold a valid proxy for the Meeting. No physical meeting will be held.

You will be able to attend the Meeting online by visiting https://web.lumiagm.com/435513610. Registered shareholders as of the Record Date and their duly appointed proxyholders also will be able to vote their shares and submit their questions online by attending the Meeting by live audio webcast.

If you hold your shares through an intermediary, such as a bank, broker or other nominee, you must register in advance using the instructions below.

To help ensure that we have a productive and efficient meeting, and in fairness to all shareholders in attendance, you will also find posted our rules of conduct for the Meeting when you log in prior to its start. These rules of conduct will include the following guidelines:

•Only registered shareholders of record as of the Record Date for the Meeting and their proxyholders may submit questions or comments electronically through the meeting portal.

•Please direct all questions to Stephen Robertson, our Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer.

•Please include your name and affiliation, if any, when submitting a question or comment.

•Limit your remarks to one brief question or comment that is relevant to the Meeting and/or our business.

•Questions may be grouped by topic by our management.

•Questions may also be ruled as out of order or not responded to if they are, among other things, irrelevant to our business or the business of the Meeting, related to pending or threatened litigation, disorderly, repetitious of statements already made, or in furtherance of the speaker’s own personal, political or business interests.

•Be respectful of your fellow shareholders and Meeting participants.

•No audio or video recordings of the Meeting are permitted.

It is important to note that if you are participating in the virtual Meeting, you must remain connected to the Internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure Internet connectivity for the duration of the Meeting.

How do I register to attend the Meeting virtually on the Internet?

If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Meeting virtually on the Internet. Please follow the instructions on the proxy card that you received.

If you are a beneficial shareholder with shares held through an intermediary, such as a bank, broker or other nominee, and wish to vote online at the Meeting (or have a third party vote on your behalf at the live webcast), you need to strike out the names of the management designees and insert your or a third party’s name into the appropriate space on the voting instruction form (the “VIF”). Do not fill out your voting instructions. Follow the instructions for submitting the VIF by the appropriate deadline, as the instructions and deadline may vary depending on the intermediary. It is important that you comply with the signature and return instructions provided by your intermediary.

You must also register yourself or the third party as a proxyholder by visiting www.investorvote.com by 12:00 p.m. (Eastern Time) on May 13, 2022 and provide Computershare with your or the third party’s contact information so that Computershare may provide you or the third party with a username via email shortly after this deadline. Without a username, you or the third party will not be able to vote or ask questions at the Meeting.

For U.S. beneficial owners, to register to attend the Meeting online by webcast, you must submit proof of your proxy power (legal proxy) reflecting your holdings in the Company, along with your name and email address to Computershare using the below contact information. Requests for registration must be labeled as “Legal Proxy” and be received no later than 12:00 p.m., Eastern Time, on May 13, 2022.

You will receive a confirmation of your registration by email after Computershare receives your registration materials.

Requests for registration should be directed to Computershare at the following:

By email:

Forward the email from your bank, broker or other nominee, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail:

Computershare

Attention: Proxy Department

100 University Avenue, 8th Floor

Toronto, Ontario, M5J 2Y1

By fax:

1-866-249-7775 for faxes sent from within Canada and the U.S. (or 1-416-263-9524 for faxes sent from outside Canada and the U.S.)

Who can vote at the Meeting?

Only shareholders of record at the close of business on April 14, 2022 (defined above as the "Record Date"), will be entitled to vote at the Meeting. On the Record Date, there were 141,741,580 common shares issued and outstanding. Each common share entitles the holder to one vote with respect to each matter submitted to shareholders at the Meeting. Each shareholder is entitled to appoint any other person to represent them at the Meeting, and at any adjournment thereof. If a shareholder

wishes to appoint a person or company other than the nominees presented by the Board, they may do so by inserting the

name of their chosen proxyholder in the space provided and as instructed on the Proxy.

Shareholder of Record: Shares Registered in Your Name

If on the Record Date your shares were registered directly in your name with our transfer agent, Computershare Trust Company of Canada, then you are a shareholder of record.

As a shareholder of record, you may vote online at the Meeting or vote by proxy. Whether or not you plan to attend the Meeting, we urge you to ensure that your vote is counted by voting by proxy over the telephone or on the Internet as instructed below, or voting by proxy using a proxy card.

If you have any questions or require assistance voting, please contact our proxy solicitation agent, Laurel Hill Advisory Group toll free within North America at 1-877-452-7184 (1-416-304-0211 Outside North America), or by email at assistance@laurelhill.com.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on the Record Date your shares were not held in your name, but rather in an account at a bank, broker or other nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the shareholder of record for purposes of voting at the Meeting. As a beneficial owner of your shares, you have the right to direct your broker or other agent as to how to vote the shares in your account. As a beneficial owner, you are invited to attend the Meeting, however, since you are not the shareholder of record, you may not vote your shares online at the Meeting unless you request and obtain a valid proxy from your broker or other agent (see above "How do I register to attend the Meeting virtually on the Internet?").

If you have any questions or require assistance voting, please contact our proxy solicitation agent, Laurel Hill Advisory Group toll free within North America at 1-877-452-7184 (1-416-304-0211 Outside North America), or by email at assistance@laurelhill.com.

In accordance with National Instrument 54-101 - Communications with Beneficial Owners of Securities of a Reporting Issuer ("NI 54-101"), the Company is distributing copies of the material related to the Meeting to clearing agencies and intermediaries for distribution to non-registered holders. Such agencies and intermediaries must forward the material related to the Meeting to non-registered holders. Management of the Company also intend to pay for intermediaries to forward the Meeting materials to objecting beneficial owners under NI 54-101.

What am I voting on?

This Proxy Statement/Circular describes the proposals on which we would like you, as a shareholder, to vote at the Meeting. This Proxy Statement/Circular provides you with information on the proposals, as well as other information about us, so that you can make an informed decision as to whether and how to vote your shares.

At the Meeting, shareholders will act upon the following three proposals:

| | | | | |

| Proposal 1 | To elect to the Board the following nine nominees presented by the Board: Dr. George M. Milne, Jr., Dr. Daniel Billen., R. Hector MacKay-Dunn, Peter Greenleaf, Joseph P. Hagan, Dr. David R.W. Jayne, Jill Leversage, Timothy P. Walbert and Dr. Brinda Balakrishnan, each to serve until the 2023 annual general meeting of shareholders or until their qualified successor has been duly elected or appointed. |

| Proposal 2 | To appoint PricewaterhouseCoopers LLP, Chartered Professional Accountants, as the Company's independent registered public accounting firm until the close of the 2023 annual general meeting of shareholders or until a successor is appointed. |

| Proposal 3 | To approve, on a non-binding advisory basis, a “say on pay” resolution regarding the Company’s executive compensation set forth in this Proxy Statement/Circular. |

In addition, shareholders will receive the financial statements of the Company for the fiscal year ended December 31, 2021, including the auditor’s report thereon (shareholders will not be asked to vote on this matter).

What if another matter is properly brought before the Meeting?

As of the date of this Proxy Statement/Circular, our Board knows of no other matters that will be presented for consideration at the Meeting. If any other matters are properly brought before the Meeting, it is the intention of the management designated proxy holder (identified on your proxy card) to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” each of the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For the appointment of the auditor, you may vote “For”, “Against” or "Abstain". For each of the other matters to be voted on, you may vote “For” or “Against” or "Abstain".

Shareholder of Record: Shares Registered in Your Name

If you are a shareholder of record, you may vote online at the Meeting, vote by proxy over the telephone or through the Internet, or vote by proxy using your proxy card. Whether or not you plan to attend the Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Meeting. If you attend the Meeting and decide to vote online during the Meeting even if you have already voted by proxy, you may vote online pursuant to the provided instructions. Doing so will revoke your prior vote.

•To vote online during the Meeting, follow the provided instructions to join the Meeting at https://web.lumiagm.com/435513610, starting at 12:00 p.m. Eastern Time on Tuesday, May 17, 2022. The webcast will open prior to the start of the Meeting and we recommend that you log in at least 15 minutes before the Meeting to ensure you are logged in when the Meeting begins.

•To vote using the proxy card, simply complete, sign and date the proxy card delivered to you and return it promptly in the envelope provided. If you return your signed proxy card to us before the Meeting by 12:00 p.m. (Eastern Time) on

May 13, 2022, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment or postponement of the Meeting, we will vote your shares as you direct.

•To vote over the telephone, dial toll-free 1-866-732-8683 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the proxy card.

•To vote through the Internet, go to www.investorvote.com to complete an electronic proxy card. You will be asked to provide the control number from the proxy card.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Nominee

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you should have received voting instructions from that organization rather than from us. Simply follow the voting instructions to ensure that your vote is counted. Aurinia may utilize Broadridge’s QuickVoteTM service to assist eligible shareholders with voting their shares directly over the phone.

Should you wish to vote online at the Meeting (or have a third party vote on your behalf via live webcast), you need to strike out the names of the management designees and insert your or a third party’s name into the appropriate space on the VIF. Do not fill out your voting instructions. Follow the instructions for submitting the VIF by the appropriate deadline, as the instructions and deadline may vary depending on the intermediary. It is important that you comply with the signature and return instructions provided by your intermediary.

For U.S. Beneficial Owners, to register to attend the Meeting online by webcast, you must submit proof of your proxy power (legal proxy) reflecting your holdings in the Company, along with your name and email address to Computershare using the contact information set out above. Requests for registration must be labeled as “Legal Proxy” and be received no later than 12:00 p.m., Eastern Time, on May 13, 2022.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share you owned as of the Record Date.

What happens if I do not vote?

Shareholder of Record: Shares Registered in Your Name

If you are a shareholder of record and do not vote by completing your proxy card, by telephone, through the Internet or online at the Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee (sometimes referred to as shares held in “street name”) and you do not provide instructions how to vote your shares, in accordance with section 153 of the Business Corporation Act (Alberta) (the "ABCA") your broker, bank or other nominee is not permitted to vote your shares.

What if I return a proxy card or otherwise vote without marking voting selections?

If you are a shareholder of record and return a signed and dated proxy card without marking voting selections, your shares will be voted, as applicable:

•“For” the election to the Board the following nine nominees presented by the Board: Dr. George M. Milne, Jr., Dr. Daniel Billen, R. Hector MacKay-Dunn, Peter Greenleaf, Joseph P. Hagan, Dr. David R.W. Jayne, Jill Leversage,

Timothy P. Walbert and Dr. Brinda Balakrishnan, each to serve until the 2023 annual general meeting of Shareholders or until their qualified successor has been duly elected or appointed.

•“For” the appointment of PricewaterhouseCoopers LLP, Chartered Professional Accountants, as the Company's independent registered public accounting firm until the close of the 2023 annual general meeting of shareholders or until a successor is appointed.

•“For” the approval, on a non-binding advisory basis, of a “say on pay” resolution regarding the Company’s approach to executive compensation.

If any other matter is properly presented at the Meeting, your proxy holder (named on your proxy card) will vote your shares using their best judgment.

Can I submit a question for the Meeting?

Shareholders who attend the Meeting and log in as a registered shareholder using their control number will have an opportunity to submit questions in writing during a portion of the Meeting. Instructions for submitting a question during the Meeting will be provided on the Meeting website. We will endeavor to answer as many submitted questions as time permits; however, we reserve the right to exclude questions regarding topics that are not pertinent to Meeting matters or company business or are, in our determination, inappropriate. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. Any questions that are appropriate and pertinent to the Meeting but cannot be answered during the Meeting due to time constraints will be answered and posted on the “Investors & Media - Governance Documents” page of our Company’s website at www.auriniapharma.com, as soon as practicable after the Meeting.

What should I do if I need technical support during the Meeting?

The Meeting platform is fully supported across browsers and devices running the most updated version of applicable software and plugins. Attendees should ensure they have a strong Internet connection, allow plenty of time to log in, and can hear streaming audio prior to the start of the Meeting.

If you experience any technical difficulties accessing the Meeting or during the Meeting, please call the toll-free number that will be available on our virtual shareholder login site at https://web.lumiagm.com/435513610 for assistance. We will have technicians ready to assist you with any technical difficulties you may have beginning 15 minutes prior to the start of the Meeting, and the technicians will be available through the conclusion of the Meeting. Additional information regarding matters addressing technical and logistical issues, including technical support during the Meeting, will be available on the Meeting website.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies associated with this Proxy Statement/Circular. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We have also engaged Laurel Hill Advisory Group to assist us in connection with the solicitation of proxies and communications with shareholders, recommending corporate governance best practices, where applicable, liaising with advisory firms, developing and implementing shareholder communication strategies and advice with respect to the Meeting and proxy protocol. In connection with these services, Laurel Hill is expected to receive a fee of CAD$35,000, plus taxes and expenses.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Shareholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the Internet.

•You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at Aurinia Pharmaceuticals Inc., #1203 - 4464 Markham Street, Victoria, BC V8Z 7X8 Canada. Notice must be received prior to the commencement of the Meeting in order to be timely.

•You may virtually attend the Meeting and vote online at the meeting. Simply attending the Meeting will not, by itself, revoke your proxy. Even if you plan to attend the Meeting, we recommend that you also submit your proxy or voting instructions or vote by telephone or through the Internet so that your vote will be counted if you later decide not to attend the Meeting.

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other nominee, you should follow the instructions provided by your broker, bank or other nominee in order to change your vote or revoke your proxy.

When are shareholder proposals and director nominations due for next year’s annual meeting?

From time to time, shareholders may present proposals, including to nominate a candidate to serve on the Board of the Company, that may be proper subjects to add to the agenda for consideration at a general meeting of shareholders. Under Section 136 of the ABCA and the regulations thereto, shareholders who hold, in the aggregate, at least 1% of the voting power in the Company, or shares whose fair market value at close of business on the day before the shareholder submits the proposal is at least $2,000, and have held them for the 6 month period preceding the submission of the proposal, may submit a request to include an item to the agenda, provided the requested item is appropriate for presentation at a general meeting and for consideration by the shareholders. The proposal must have support from shareholders holding at least 5% of the voting power in the Company to be validly submitted. The proposal must be submitted at least 90 days before the anniversary date of the last annual meeting of the Company's shareholders (being February 16, 2023 for the 2023 annual general meeting of shareholders, based on the planned date for the Meeting).

In addition, shareholder proposals may be submitted for inclusion in a proxy statement under Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under Rule 14a-8 of the Exchange Act, to be eligible for inclusion in the Company’s proxy materials for the 2023 annual general meeting of Shareholders, shareholder proposals must be received by the Company not later than December 22, 2022, which is 120 days prior to the 12-month anniversary of the date this Proxy Statement/Circular was first released to shareholders with respect to the Meeting. In addition, Rule 14a-8 proposals must otherwise comply with the requirements of the rule, including minimum shareholding requirements for the proposer in order for a shareholder proposal to be valid. This date will change if the date of 2023 Annual General Meeting of Shareholders is 30 calendar days earlier or later than May 17, 2023.

Accordingly, shareholders should submit any proposals for inclusion in the Company’s proxy materials prior to December 22, 2022 to be in compliance with both requirements.

The Company’s by-laws include advance notice provisions (the “Advance Notice Provisions”) that require that advance notice must be provided to the Company in circumstances where nominations of persons for election to the Board are made by shareholders other than pursuant to: (i) a “proposal” made in accordance with the ABCA; or (ii) a requisition of the shareholders made in accordance with the ABCA.

Among other things, the Advance Notice Provisions fix a deadline by which holders of record of common shares must submit director nominations to the secretary of the Company prior to any annual or special meeting of shareholders and sets forth the specific information a shareholder must include in the written notice to the secretary of the Company for an effective nomination to occur. No person will be eligible for election as a director unless nominated in accordance with the provisions of the Advance Notice Provisions.

In the case of an annual meeting of shareholders, notice to the Company must be made not less than 30 nor more than 65 days prior to the date of the annual meeting; provided, however, in the event that the annual meeting is to be held on a date that is less than 60 days after the date on which the first public announcement of the date of the annual meeting was made, notice may be made not later than the close of business on the tenth day following such public announcement.

The foregoing is merely a summary of the Advance Notice Provisions, and is not comprehensive and is qualified by the full text of such provisions. The full text of such provisions is set out in Section 14 of our Amended and Restated By-law No. 2, which is filed as Exhibit 3.2 on our Form 8-K filed on April 27, 2021, which can be found at www.sec.gov.

Proposals should be addressed to: Aurinia Pharmaceuticals Inc., #1203 - 4464 Markham Street, Victoria, BC V8Z 7X8 Canada, Attn: Corporate Secretary.

We received no shareholder proposals for the Meeting. In addition, the deadline to provide valid notice of any director nominations according to the Advance Notice Provisions was April 14, 2022. As of the date hereof, the Company has not received any nominations for director from any third party.

How are votes counted?

Votes will be counted by the scrutineer appointed for the Meeting, who will separately count, for proposal 1, votes "For" or "Withhold"; with respect to proposal 2, votes “For”, "Against” or "Abstain"; and with respect to proposal 3, votes “For,” "Against" or "Abstain". No broker non-votes will be counted.

What are “broker non-votes”?

When a beneficial owner of shares held in “street name” does not give instructions to his or her bank, broker or other nominee holding the shares as to how to vote on a matter, under the ABCA the bank, broker or other nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

As a reminder, if you are a beneficial owner of shares held in “street name,” in order to ensure your shares are voted, you must provide voting instructions to your bank, broker or other nominee holding the shares by the deadline provided in the materials you receive from your bank, broker or other nominee.

How many votes are needed to approve each proposal?

On each proposal to be voted upon, shareholders have one vote for each share owned as of the Record Date. Votes will be counted by the scrutineer. The following table summarizes vote requirements and the effect of abstentions and broker non-votes:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Proposal Number | | Proposal Description | | Vote Required for Approval | | Effect of Abstentions | | Effect of Broker Non-Votes |

| 1 | | The election to the Board of Directors the following nine nominees presented by the Board: Dr. George M. Milne, Jr., Dr. Daniel Billen, R. Hector MacKay-Dunn, Peter Greenleaf, Joseph P. Hagan, Dr. David R.W. Jayne, Jill Leversage, Timothy P. Walbert and Dr. Brinda Balakrishnan. | | Directors will individually be elected by a plurality of the votes cast at the Meeting by the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. If you select “WITHHOLD” with respect to the election of a nominee, your vote will not be counted as a vote cast for the purposes of electing such nominee but will be considered in the application of the Company’s Majority Voting Policy. In order not to be subject to the application of our Majority Voting Policy, as further described on page 21, each director nominee must receive more “FOR” votes than “WITHHOLD” votes. | | None | | None |

| | | | | | | | |

| 2 | | To approve the appointment of PricewaterhouseCoopers LLP, Chartered Professional Accountants, as the Company's independent registered public accounting firm until the close of the 2023 Annual General Meeting of shareholders or until a successor is appointed. | | FOR votes from the holders of a majority of votes cast on the question. For purposes of this proposal, votes cast at the Meeting include only those votes cast “FOR” the appointment of the proposed independent registered public accounting firm. If you vote “FOR” the appointment of the proposed independent registered public accounting firm, your vote will be cast accordingly. If you select “AGAINST” or "ABSTAIN" your vote will not be counted as a vote cast for purposes of appointing the proposed independent registered public accounting firm. | | None | | None |

| | | | | | | | |

| 3 | | To approve, on a non-binding advisory basis, a “say on pay” resolution regarding the Company’s executive compensation. | | FOR votes from the holders of a majority of votes cast on the question. Although this is an advisory vote, the Board will consider the results of the advisory vote when considering future decisions related to such proposal. | | None | | None |

| | | | | | | | |

What is the quorum requirement?

A quorum of shareholders is necessary for the transaction of business at any meeting of shareholders. A quorum will be present if at least two (2) shareholders, each being a shareholder entitled to vote or a duly appointed proxy or representative for any absent shareholder so entitled, who hold, in the aggregate, no less than thirty-three and one-third percent (33 1/3%) of the outstanding shares of the Company carrying voting rights at the meeting. On the Record Date, there were 141,741,580 shares outstanding and entitled to vote. Thus, the holders of at least 47,247,193 shares must be present via remote attendance or represented by proxy at the Meeting to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you attend online at the Meeting. If there is no quorum, the holders of a majority of shares present at the Meeting via virtual attendance or represented by proxy may adjourn the Meeting to another date.

How can I find out the Meeting voting results?

Preliminary voting results will be announced at the Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Meeting. If final voting results are not available to us in time to file a current report on Form 8-K within four business days after the Meeting, we intend to file a current report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended current report on Form 8-K to publish the final results.

RECEIPT OF FINANCIAL STATEMENTS

At the Meeting, shareholders will receive and consider the financial statements of the Company for the year ended December 31, 2021 and the auditor’s report thereon, but no vote by the shareholders with respect thereto is required or proposed to be taken.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This management information circular / proxy statement and the accompanying letter (together, the "Meeting Materials") contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which are subject to the “safe harbor” created by those sections, as well as “forward-looking information” as defined in applicable Canadian securities laws. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth below and in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2021 (the "2021 Annual Report").

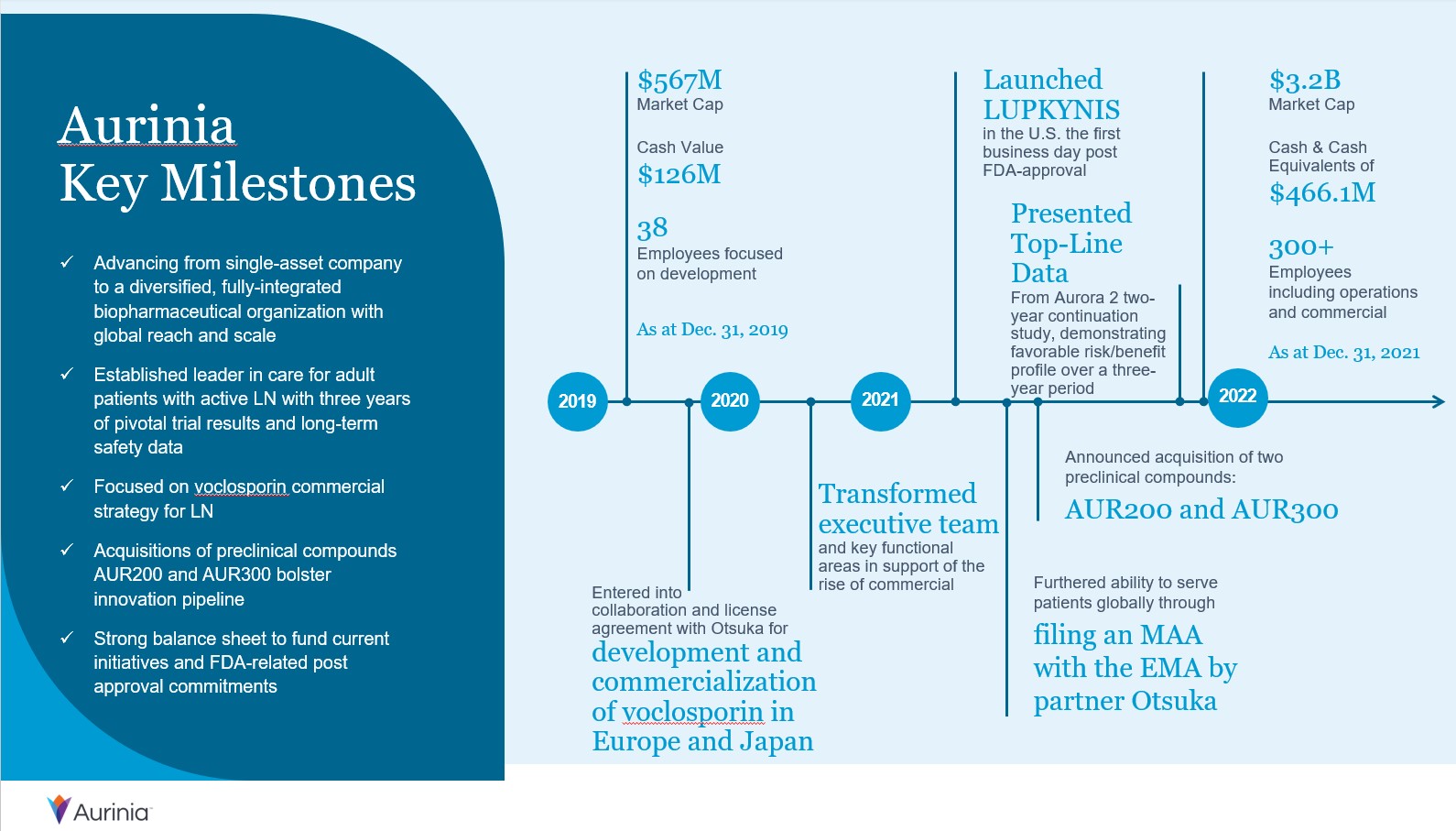

A statement is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements may include words such as “anticipate”, “believe”, “intend”, “expect”, “goal”, “may”, “outlook”, “plan”, “seek”, “project”, “should”, “strive”, “target”, “could”, “continue”, “potential”, “estimated”, "would", and "will" or the negative of such terms or comparable terminology. You should not place undue reliance on the forward-looking statements, particularly those concerning anticipated events relating to the development, clinical trials, regulatory approval, and marketing of LUPKYNISTM (voclosporin) or any other aspect of our business and the timing or magnitude of those events, as they are inherently risky and uncertain.

These forward-looking statements include, but are not limited to, statements concerning the following:

•our plans and expectations and the timing of commencement, enrollment, completion and release of results of clinical trials;

•our belief in the accuracy of our net revenue guidance of $115-$135 million in sales during fiscal 2022;

•our belief in the timing of receipt of the EMA approval for sales of LUPKYNIS;

•the potential impact of COVID-19 on our business operations, nonclinical and clinical trials, regulatory timelines, supply chain, and potential commercialization; and

•our belief that we will file Investigational New Drug Applications (INDs) for AUR200 and AUR300 in 2023.

Such statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based on a number of estimates and assumptions that, while considered reasonable by management, as at the date of such statements, are inherently subject to significant business, economic, competitive, political, regulatory, legal, scientific and social uncertainties and contingencies, many of which, with respect to future events, are subject to change. The factors and

assumptions used by management to develop such forward-looking statements include, but are not limited to:

•the assumption that we will be able to obtain approval from regulatory agencies on executable development programs with parameters that are satisfactory to us;

•the assumption that recruitment to clinical trials will occur as projected;

•the assumption that we will successfully complete and enroll our clinical programs in compliance with good clinical practices (GCP) on a timely basis and meet regulatory requirements for approval of marketing authorization applications and new drug approvals, as well as favorable product labeling;

•the assumption that the planned studies will achieve positive results;

•the assumptions regarding the costs and expenses associated with our clinical trials and commercialization of LUPKYNIS;

•the assumption that regulatory requirements and commitments will be maintained;

•the assumption that we will be able to meet good manufacturing practice (GMP) standards and manufacture and secure a sufficient supply of LUPKYNIS on a timely basis to successfully complete the development and commercialization of LUPKYNIS;

•the assumption that our patent portfolio is sufficient and valid;

•the assumption that we will be able to extend our patents to the fullest extent allowed by law, on terms most beneficial to us;

•the assumptions about future market activity;

•the assumption that there is a potential commercial value for LUPKYNIS and other indications for voclosporin;

•the assumption that another company will not violate our intellectual property rights or regulatory exclusivity periods;

•the assumption that our current good relationships with our suppliers, service providers and other third parties will be maintained;

•the assumption that we will be able to attract and retain a sufficient amount of skilled staff; and

•the assumption that our third party service providers and partners will comply with their contractual obligations.

It is important to know that:

•actual results could be materially different from what we expect if known or unknown risks affect our business, or if our estimates or assumptions turn out to be inaccurate. As a result, we cannot guarantee that any forward-looking statement will materialize and, accordingly, you are cautioned not to place undue reliance on these forward-looking statements; and

•forward-looking statements do not take into account the effect that transactions or non-recurring or other special items announced or occurring after the statements are made may have on our business. Accordingly, the expected impact cannot be meaningfully described in the abstract or presented in the same manner as known risks affecting our business.

The factors discussed below and other considerations discussed in the "Risk Factors" section of our 2021 Annual Report could cause our actual results to differ significantly from those contained in any forward-looking statements.

If our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. Any forward-looking statement made by us speaks only as of the date of the Meeting Materials or as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the filing date of the Meeting Materials, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

We qualify all of our forward-looking statements by these cautionary statements.

PROPOSAL 1

ELECTION OF DIRECTORS

The following section states the names of all of the persons proposed to be nominated by the Company for election as directors, their municipality, province or state and country of residence, their age, their principal occupation, their position in the Company (if any), and the period during which each proposed nominee has served as a director.

The persons named in the Proxy intend to cast the votes to which the shares represented by such Proxy are entitled FOR the election of each of the nominees to the Board set forth in this Proxy Statement/Circular, unless otherwise directed by the shareholders instructing them.

The Company is not aware that any of the below nominees will be unable or unwilling to serve; however, should the Company become aware of such an occurrence before the election of directors takes place at the Meeting, if one of the persons named in the Proxy is appointed as proxy holder, it is intended that the discretionary power granted under such Proxy will be used to vote for any substitute nominee or nominees whom the Company in its discretion may select.

Directors are elected by a plurality of the votes of the holders of shares present by remote attendance or represented by proxy and entitled to vote on the election of directors. Accordingly, the nine nominees receiving the highest number of affirmative votes will be elected. However, in order not to be subject to the application of our Majority Voting Policy, as further described below, each director nominee must receive more “FOR” votes than “WITHHOLD” votes. Holders of proxies solicited by this Proxy Statement/Circular will vote the proxies received by them as directed on the proxy card or, if no direction is made, for the election of the Board’s nine nominees. If elected, each director will hold office until the next annual meeting of shareholders or until their successor is duly elected, unless their office is vacated earlier in accordance with the by-laws of the Company or the ABCA.

Nominees for Election

Our Governance & Nomination Committee of the Board ("G&N Committee") and our Board seek to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct our business. To that end, our Board has identified and evaluated nominees in the broader context of our Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that our Board views as critical to effective functioning of our Board. The brief biographies below include information, as of the date of this Proxy Statement/Circular, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that qualify such director or nominee to serve on our Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name, Province, State and Country of Residence | | Date First Elected / Appointed | | Age | | Present Principal Occupation | | Position Held With the Company |

Dr. George M. Milne, Jr. Boca Grande, Florida United States | | May 8, 2017 | | 78 | | Venture Partner at Radius Ventures LLC, a venture capital firm; Lead Director at Charles River Laboratories, a pre-clinical and clinical laboratory services corporation; and Chair of Amylyx Pharmaceuticals, Inc., a pharmaceutical company | | Chairman of the Board |

Peter Greenleaf Bethesda, Maryland United States | | April 29, 2019 | | 52 | | President and Chief Executive Officer ("CEO") of the Company | | Director, President and Chief Executive Officer |

Dr. David R. W. Jayne Cambridge United Kingdom | | May 26, 2015 | | 65 | | Professor of Clinical Autoimmunity in the Department of Medicine at the University of Cambridge, UK; fellow of the Royal Colleges of Physicians of London and Edinburgh, and the Academy of Medical Science; certified nephrologist and an Honorary Consultant Physician at Addenbrooke’s Hospital, Cambridge UK | | Director |

Joseph P. Hagan La Jolla, California United States | | February 7. 2018 | | 53 | | President and CEO of Regulus Therapeutics Inc., a biopharmaceutical company | | Director |

Dr. Daniel G. Billen Mississauga, Ontario Canada | | April 29, 2019 | | 68 | | Retired, previously commercial GM/VP at Amgen Inc., a biotechnology company | | Director |

R. Hector MacKay-Dunn Vancouver, British Columbia Canada | | June 26, 2019 | | 71 | | Senior Partner, Farris LLP | | Director |

Jill Leversage Vancouver, British Columbia Canada | | November 13, 2019 | | 65 | | Corporate Director | | Director |

Timothy P. Walbert Park Ridge, Illinois United States | | April 20, 2020 | | 55 | | Chairman of the board, President and Chief Executive Officer of Horizon Therapeutics plc, a biotechnology company, since creating the company in 2008 | | Director |

Dr. Brinda Balakrishnan San Francisco, California United States | | June 14, 2021 | | 42 | | Senior Vice President, Chief Business Development Officer of BioMarin Pharmaceutical Inc. | | Director |

Dr. George M. Milne, Jr., PhD, Director, Chairman of the Board

Dr. George Milne has over 30 years of experience in pharmaceutical research and product development, including over 20 years of experience as a board member and lead director of multiple biopharmaceutical companies. Dr. Milne currently serves on the boards of Amylyx Pharmaceuticals, Inc. (NASDAQ: AMLX), a pharmaceutical company, where he is the Chair, and Charles River Laboratories, Inc. (NYSE CRL), a laboratory services company, where he is the lead director. He retired from Pfizer Inc. in 2002 where he served as Executive Vice President of Global Research and Development and President, Worldwide Strategic and Operations Management. He joined Pfizer Inc. in 1970 and held a variety of positions conducting both chemistry and pharmacology research. Dr. Milne became director of the department of immunology and infectious diseases at Pfizer Inc. in 1981, was its executive director from 1984 to 1985, and was Vice President of research and development from 1985 to 1988. He was appointed Senior Vice President in 1988. In 1993, he was appointed President of Pfizer Central Research and a Senior Vice President of Pfizer Inc. with global responsibility for human and veterinary medicine research and development. Dr. Milne has also previously served on multiple corporate boards including Mettler-Toledo, Inc. (a manufacturer of laboratory

instruments), MedImmune, Athersys, Biostorage Technologies, Aspreva and Conor Medsystems. Dr. Milne received his B.Sc. in Chemistry from Yale University and his Ph.D. in Organic Chemistry from Massachusetts Institute of Technology. Our Board believes Dr. Milne’s background, corporate pharmaceutical experience, as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

Peter Greenleaf, MBA, Director, President and CEO

Peter Greenleaf currently serves as the President, Chief Executive Officer and member of the Board since April 29, 2019. From March 2018 to April 2019, Peter served as the Chief Executive Officer and a member of the board of directors of Cerecor, Inc. (NASDAQ: CERC). From March 2014 to February 2018, Peter served as CEO and Chairman of Sucampo Pharmaceuticals, Inc. (NASDAQ: SCMP), a company that focused on the development and commercialization of medicines to meet major unmet medical needs of patients worldwide until it was sold in February 2018 to U.K. pharmaceutical giant Mallinckrodt plc. Peter also served as Chief Executive Officer and a member of the board of directors of Histogenics Corporation, a regenerative medicine company. From 2006 to 2013, Peter was employed by Medlmmune LLC, the global biologics arm of AstraZeneca, where he most recently served as President. From January 2010 to June 2013, Peter also served as President of Medlmmune Ventures, a wholly owned venture capital fund within the AstraZeneca Group. Prior to serving as President of Medlmmune, Peter was Senior Vice President, Commercial Operations of MedImmune, responsible for its commercial, corporate development and strategy functions. Peter has also held senior commercial roles at Centocor, Inc. (now Janssen Biotechnology, Johnson & Johnson) from 1998 to 2006, and at Boehringer Mannheim (now Roche Holdings) from 1996 to 1998. He is also currently a member of the board of directors of Antares Pharmaceuticals, Inc. (NASDAQ: ATRS), and was the Chairman of the board of directors of BioDelivery Sciences International, Inc (NASDAQ: BDSI) until its sale to Collegium Pharmaceuticals in March 2022. Peter earned an MBA degree from St. Joseph’s University and a BS degree from Western Connecticut State University. Our Board believes Mr. Greenleaf’s background, role with the Company, corporate pharmaceutical experience as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

Dr. David R.W. Jayne, MD FRCP FRCPE FMedSci, Director

Dr. David Jayne has been a Professor of Clinical Autoimmunity in the Department of Medicine at the University of Cambridge, UK since 2017. Dr. Jayne received his MBBChir in Surgery and Medicine from Cambridge University, Cambridge, England. He received postgraduate training at several London hospitals and Harvard University. He is a fellow of the Royal College of Physicians of London and Edinburgh, and the Academy of Medical Science. He is a certified nephrologist and an Honorary Consultant Physician at Addenbrooke’s Hospital, Cambridge UK. Dr. Jayne is a medical advisor to UK, U.S. and EU regulatory bodies, patient groups and professional organizations. He has published more than 400 peer-reviewed journal articles, book chapters and reviews. He was elected the first President of the European Vasculitis Society in 2011 and is a member of the ERA-EDTA immunopathology working group and he co-chairs the EULAR/ERA-EDTA task force on lupus nephritis. Dr. Jayne’s research includes investigator-initiated international trials and the introduction of newer therapies in vasculitis and SLE with collaborators on five continents. Our Board believes Dr. Jayne’s background and medical expertise in the nephrology area, as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

Joseph P. "Jay" Hagan, Director, Chair of the Compensation Committee

Joseph Hagan is President, Chief Executive Officer and a member of the board of directors of Regulus Therapeutics, Inc. (NASDAQ: RGLS). Jay joined Regulus Therapeutics, Inc. in January 2016 as Chief Operating Officer, Principal Financial Officer and Principal Accounting Officer and was appointed to President and Chief Executive Officer in May 2017. Jay’s career includes roles as the Executive Vice President, Chief Financial Officer and Chief Business Officer of Orexigen Therapeutics, Inc., Managing Director of Amgen Ventures and head of corporate development for Amgen Inc. Jay has led numerous strategic and financing transactions including the acquisitions of Immunex and Tularik and the spinout of Novantrone and Relyspa, as well as many other business development efforts totaling over $15 billion in value. Before joining Amgen, Jay spent five years in the bioengineering labs at Genzyme and Advanced Tissue Sciences. Jay currently serves on the board of directors of Zosano Pharma Corporation (NASDAQ: ZSAN), a publicly traded biotechnology company. He received an MBA from Northeastern University and a BS in Physiology and Neuroscience from the University of California, San Diego. Our Board believes Mr. Hagan’s background, corporate and financial pharmaceutical experience, as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

Dr. Daniel G. Billen, Ph.D., Director

Dr. Daniel Billen has over 40 years of experience in commercialization of pharmaceutical and biotech products both in Europe and North America. He started with Janssen Pharmaceuticals in its Belgian headquarters in cardiovascular global marketing in

1979. Dr. Billen became head of marketing and sales for Janssen Pharmaceutica’s newly formed affiliate in Canada in 1983 launching multiple products into the Canadian market. In 1991, Dr. Billen moved to Amgen Inc. to lead its Canadian operations as their first General Manager. He moved to Amgen’s headquarters in California in 2011 where he led the U.S. Commercial Operations Business Unit and later the combined Nephrology and Inflammation business unit as their VP/GM. In 2017, Dr. Billen took on the role of VP of Global Commercial initiatives with focus on the evolving US payer landscape. Dr. Billen received his PhD in chemistry from the University of Louvain in Belgium. Our Board believes Dr. Billen’s background, corporate pharmaceutical experience, as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

R. Hector MacKay-Dunn, J.D., Q.C., Director, Chair of the Governance & Nomination Committee

Mr. MacKay-Dunn has over 30 years of practice experience providing legal advice to high growth public and private companies, many of which achieving valuations exceeding $1billion over a broad range of industry sectors including life sciences, health and technology, advising on corporate domestic and cross border public and private securities offerings, mergers and acquisitions and international partnering and licensing transactions, and Boards of Directors and independent board committees on corporate governance matters. Mr. MacKay-Dunn has been recognized by Lexpert® as being among the top 100 Canada/US cross-border corporate lawyers in Canada, in the 2021 Lexpert® Special Edition of Technology; in the 2020 Lexpert® Special Editions of Global Mining and Infrastructure, and in the 2022 Canadian Legal Lexpert® Directory, by Best Lawyers in Canada in the areas of Biotech, M&A, Corporate & Securities and Tech for 2022 and Lawyer of the Year 2020 in Biotech. Mr. MacKay-Dunn received the Queen’s Counsel designation upon recommendation by the Attorney General of British Columbia for exceptional merit and contribution to the legal profession, the "AV” preeminent legal ability rating from Martindale-Hubbell, and is regularly recognized as a Leading lawyer Nationally by Chambers Canada within the Life Sciences Category. Mr. MacKay-Dunn as served as Board Member or Officer with Aspreva Pharmaceuticals Corporation, Arbutus Biopharma Corp., XBiotech Inc. and QLT Inc., the BC (British Columbia) Tech Association, Lifesciences British Columbia, Genome British Columbia and Tennis Canada. Our Board believes his background and broad legal practices as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

Jill Leversage, Director, Chair of the Audit Committee

Prior to Ms. Leversage’s retirement in January 2016, she was a senior investment banker with over 30 years of experience in investment banking and private equity. She was a Managing Director, Corporate and Investment Banking for TD Securities Inc. from May 2002 to May 2011 and Former Managing Director at Highland West Capital Ltd. from June 2013 to January 2016. She currently serves on several public and private company boards, including MAG Silver Corp. (TSX/NYSE A: MAG) (a mining company) and RE Royalties Ltd. (TSXV: RE) (a finance company specializing in renewable energy). She is a fellow of the Institute of Chartered Professional Accountants of British Columbia and also a Chartered Business Valuator (ret.) of the Canadian Institute of Chartered Business Valuators. Our Board believes her background, financial experience and qualifications as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies her to serve on the Board.

Timothy P. Walbert, Director

Timothy P. Walbert has been President and Chief Executive Officer of Horizon Therapeutics plc (NASDAQ: HZNP) since 2008 and has served as Chairman of its board of directors since 2010. Prior to joining Horizon, he served as President, Chief Executive Officer and Director of IDM Pharma, Inc., a public biopharmaceutical company which was acquired by Takeda in 2009. From 2006 to 2007, Mr. Walbert served as Executive Vice President, commercial operations at NeoPharm, Inc., a public biopharmaceutical company. From 2001 to 2005, he served as divisional Vice President and General Manager, immunology, where he led the global development and launch of the multi-indication biologic HUMIRA and divisional Vice President, global cardiovascular strategy at Abbott, now AbbVie. From 1998 to 2001, Mr. Walbert served as Director, CELEBREX North America and arthritis team leader, Asia Pacific, Latin America and Canada at G.D. Searle & Company, now Pfizer. From 1991 to 1998, he also held sales and marketing roles with increasing responsibility at G.D. Searle, Merck & Co., Inc. and Wyeth, now Pfizer. He serves on the board of directors of the Illinois Biotechnology Innovation Organization (IBIO), the Biotechnology Innovation Organization (BIO), World Business Chicago and the Greater Chicago Arthritis Foundation. He is a member of the Illinois Innovation Council, the National Organization for Rare Disorders (NORD) Advisory Board and serves on the Board of Trustees of Muhlenberg College. Mr. Walbert received his Bachelor of Arts in Business from Muhlenberg College, in Allentown, Pennsylvania. Our Board believes Mr. Walbert’s background and corporate biopharmaceutical experience as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

Dr. Brinda Balakrishnan, M.D., Ph.D., Director

Dr. Balakrishnan has been at BioMarin Pharmaceeutical Inc. (NASDAQ: BMRN) since 2016, currently serving as Senior Vice President, Chief Business Development Officer. Prior to joining BioMarin, Dr. Balakrishnan was the co-founder and Vice President of corporate strategy and product development at Vision Medicines, Inc., a start-up focused on developing treatments for rare ophthalmic diseases. Before Vision Medicines, she spent two years as a consultant at McKinsey & Company in the healthcare practice, serving clients across small biotech, large pharma, and healthcare provider groups on topics related to corporate strategy, corporate and business development, and operations. Prior to McKinsey, Dr. Balakrishnan was in business development at Genzyme.

Dr. Balakrishnan earned a B.S. degree from the Massachusetts Institute of Technology (MIT) in chemical engineering and a Ph.D. from MIT in biomedical engineering and chemical engineering. She also earned her M.D. degree from Harvard Medical School and conducted her medical training in internal medicine at Beth Israel Deaconess Medical Center in Boston, a Harvard hospital. Our Board believes Dr. Balakrishnan's background, corporate pharmaceutical experience as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies her to serve on the Board.

Skills Matrix

The Company’s director nominees bring a number of skills and experience to the Board. The image below gives a snapshot of the top skills of each director nominee. You can read about each nominee in the director nominee profiles above.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dr. George M. Milne, Jr. | Peter Greenleaf | Jill Leversage | Dr. David R.W. Jayne | Joseph P. Hagan | Dr. Daniel G. Billen | R. Hector MacKay-Dunn | Timothy P. Walbert | Dr. Brinda Balakrishnan |

Management/operations | √ | √ | √ | √ | √ | √ | | √ | √ |

CEO/CFO/COO experience | | √ | √ | | √ | | | √ | |

Industry experience | √ | √ | | √ | √ | √ | √ | √ | √ |

Commercialization | √ | √ | | | √ | √ | | √ | |

Manufacturing/supply chain | √ | √ | | | √ | √ | | √ | |

Government relations | √ | √ | | √ | | √ | √ | √ | |

Finance/financial industry | | √ | √ | | √ | √ | √ | √ | √ |

Accounting/auditing |

| √ | √ | | √ | | | | |

Risk management | √ | | | | √ | √ | √ | √ | |

Strategy development | √ | √ | | | √ | √ | √ | √ | √ |

Mergers & acquisitions | √ | √ | √ | | √ | √ | √ | √ | √ |

Legal/regulatory | √ | √ | | | | | √ | √ | |

Corporate governance | √ | √ | √ | | √ | √ | √ | √ | |

Capital markets | | √ | √ | | √ | | √ | √ | √ |

Executive compensation | √ | √ | √ | | √ | √ | √ | √ | |

Information technology | | √ | | | | | | √ | |

Research/development | √ | √ | | √ | √ | √ | | √ | √ |

Clinical development | √ | √ | | √ | √ | | | √ | √ |

Business development | √ | √ | √ | | √ | √ | √ | √ | √ |

Board Diversity Matrix

The following table sets out voluntarily disclosed information regarding certain diversity elements for our Board of Directors.

| | | | | | | | | | | | | | |

| Board Size |

| Total Number of Directors | 9 |

| Female | Male | Non-Binary | Did not Disclose Gender |

| Gender: |

| Directors | 2 | 7 | — | — |

| Number of Directors who identify in Any of the Categories Below: |

| | | | |

| | | | |

| Asian | 1 | — | — | — |

| | | | |

| | | | |

| White | 1 | 7 | — | — |

| | | | |

| LGBTQ+ | — | — | — | — |

| Persons with Disabilities | — | — | — | — |

Majority Voting Policy

The Company has adopted a Majority Voting Policy where if, with respect to any particular nominee being voted on for election at any meeting where shareholders vote on the uncontested election of directors, the number of shares withheld exceeds the number of shares voted in favor of the nominee, then for purposes of the Majority Voting Policy the nominee shall be considered not to have received the support of the shareholders, even though duly elected as a matter of corporate law. If a director receives more withheld votes than for votes at the election of directors, pursuant to our Majority Voting Policy such director is required to forthwith tender their resignation. An uncontested election means the number of director nominees for election is the same as the number of directors to be elected to the Board. Within 90 days of the relevant shareholders’ meeting, the Board will make its determination whether or not to accept the resignation and issue a press release either announcing the resignation of the director or explaining the reasons justifying its decision not to accept the resignation. The Board will accept the resignation absent exceptional circumstances and such resignation will be effective when accepted by the Board. A director who tenders a resignation pursuant to this policy will not participate in any meeting of the Board or any committee at which the resignation is considered.

The directors have agreed to comply with the Company’s Majority Voting Policy, pursuant to the language in such policy “Any future nominees for election to the Board will be asked to agree to comply with this policy before they are nominated for election, or otherwise appointed, to the Board.”

Advance Notice Requirements

The Company’s by-laws include advance notice provisions (the "Advance Notice Provisions") that require that advance notice must be provided to the Company in circumstances where nominations of persons for election to the Board are made by shareholders other than pursuant to: (i) a "proposal" made in accordance with the ABCA; or (ii) a requisition of the shareholders made in accordance with the ABCA.

Among other things, the Advance Notice Provisions fix a deadline by which holders of record of common shares must submit director nominations to the secretary of the Company prior to any annual or special meeting of shareholders and sets forth the specific information a shareholder must include in the written notice to the secretary of the Company for an effective nomination to occur. No person will be eligible for election as a director unless nominated in accordance with the provisions of the Advance Notice Provisions.

In the case of an annual meeting of shareholders, notice to the Company must be made not less than 30 nor more than 65 days prior to the date of the annual meeting; provided, however, in the event that the annual meeting is to be held on a date that is less than 60 days after the date on which the first public announcement of the date of the annual meeting was made, notice may be made not later than the close of business on the tenth day following such public announcement.

In the case of a special meeting of shareholders (which is not also an annual meeting), notice to the Company must be made not later than the close of business on the tenth day following the day on which the first public announcement of the date of the special meeting was made.

The Board may, in its sole discretion, waive any requirement of the Advance Notice Provisions.

The deadline to provide valid notice of any director nominations according to the Advance Notice Provisions was April 14, 2022. As of the date hereof, the Company has not received any nominations for director from any third party.

Required Vote

Directors will individually be elected by a plurality of the votes cast at the Meeting by the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. However, under our Majority Voting Policy, as further described above, a director is required to forthwith tender their resignation if the director receives more ‘WITHHOLD” votes than “FOR” votes. Abstentions will have no effect and broker non-votes will not be counted.

Our Board of Directors unanimously recommends

that you vote “FOR” each named nominee.

INFORMATION REGARDING THE BOARD OF DIRECTORS

AND CORPORATE GOVERNANCE

Corporate Governance Highlights and Guidelines

We recognize the importance of a good framework for sound, long-term oriented governance. We are committed to the highest standards of corporate governance and generally align our corporate governance with the best practice principles. We highlight our following best practices with regard to governance:

| | | | | | | | | | | | | | |

ü Majority of the Board is independent (88.9% under US/Nasdaq rules; 77.8% under Canadian rules) | | ü Annual board and committee self- evaluation

| | ü Majority voting in uncontested elections

|

ü Presiding Chairman is an independent director | | ü Proxy access | | ü No poison pill in effect

|

ü Separate Non-Executive Board Chair and CEO roles | | ü Annual director elections | | ü Stock ownership guidelines for directors |

ü Independent Audit, Compensation and Governance & Nomination Committees | | ü Regular executive sessions of independent directors | | ü Regular director refreshment |

Independence of the Board of Directors

Applicable Nasdaq rules require a majority of a listed company’s board of directors to be comprised of independent directors. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act. The Nasdaq independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees, that neither the director nor any of his family members has engaged in various types of business dealings with us and that the director is not associated with the holders of more than 5% of our common shares. In addition, under applicable Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of the listed company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Board has determined that all of our directors, except Peter Greenleaf, are independent directors, as defined under applicable Nasdaq rules. In making such determination, our Board considered the relationships that each such non-employee director has with our Company and all other facts and circumstances that our Board deemed relevant in determining his or her independence, including the beneficial ownership of our capital stock by each non-employee director. Mr. Greenleaf is considered to have a material relationship with the Company by virtue of being the President and CEO of the Company.